When your business is just starting out in the healthcare industry, you may have had to rely on the accounting software QuickBooks for your financial management needs.

That’s because QuickBooks would have been an affordable, yet sufficient tool at the small scale at the time your business was newly-established.

However, as your healthcare business continued to grow and maybe even began expanding to multiple locations within the country or the region, you’ve probably come to realize how the limitations of QuickBooks is holding back your business expansion.

And you may have also experienced how QuickBooks’ limited feature set, as well as lack of flexibility and scalability, makes it less suitable for your business’s industry-specific operational needs by the day.

Because of this, you’d want to consider upgrading your healthcare business to a more robust and flexible financial management solution; for example, a true cloud ERP software such as Oracle NetSuite.

Let’s take a look at the limitations of QuickBooks that result in pain points for your healthcare business, and how upgrading to NetSuite can resolve them.

How NetSuite Is A Superior Option Over QuickBooks For Pharmaceutical Businesses

/Oracle_NetSuite.webp?width=1000&name=Oracle_NetSuite.webp)

1. NetSuite Has A More Robust Financial Management Feature Set Than QuickBooks

While QuickBooks comes with a core set of accounting functions, it is limited in scope. This forces healthcare businesses like yours to adapt your processes to fit its limitations.

Other financial functions outside of QuickBooks’ scope will also have to be carried out by third-party services, or via add-ons. This means manual data entry processes are required to transfer critical financial data between systems, leading to errors in the data that could prove costly.

On the other hand, NetSuite offers a robust feature set for financial management, which includes functions that QuickBooks lack and/or require workarounds for.

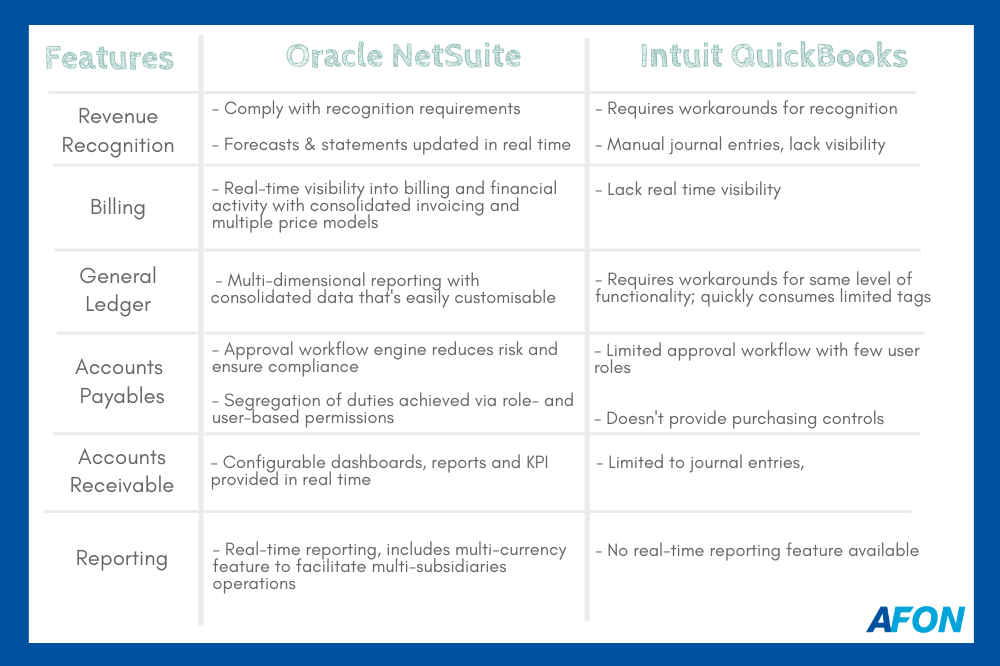

Here’s a comparison of the financial management features of QuickBooks and NetSuite:

With NetSuite, your healthcare business can easily comply with revenue recognition requirements, with financial statements and forecasts that are updated in real-time.

On the other hand, you need to implement workarounds to make revenue recognition possible with QuickBooks, and even then the process is complicated with manual journal entries, complicated recognition schedule spreadsheets, and lack of forward visibility.

When it comes to billing, QuickBooks is not able to provide real-time visibility into your billing processes. On the other hand, NetSuite not only provides this, but also improves transparency into them through consolidated invoicing, automated rating processes, and support of multiple price models.

NetSuite’s general ledger (G/L) feature provides accounting data from a consolidated level down to the individual, is easily customised to meet the specific business needs of the healthcare industry, and has multi-dimensional reporting which enables the creation of a simple chart of accounts.

To achieve similar functionality, QuickBooks relies on tags, which are limited in number and are quickly depleted as users implement workarounds.

For accounts payable and receivable (AP/AR), NetSuite offers an approval workflow engine, which reduces risk by ensuring that purchasing and accounting controls and policies are followed. It also enforces segregation of duties with role- and user-based permissions, and provides configurable dashboards, reports and KPIs which provide a real-time view of AR data.

On the other hand, QuickBooks has a limited approval workflow and number of user roles. This means it can’t deliver strong controls or true segmentation of duties. It also doesn’t provide purchasing controls, and when it comes to AR, it offers only journal entries, and cannot handle downloads and schedules.

Last but not least, QuickBooks lacks real-time financial reporting. On the other hand, NetSuite offers various real-time reports such as revenue forecasting, as well as consolidated parent and subsidiary reports. Its multi-currency feature also allows you to report using the local currency of the countries where your subsidiaries are located.

2. NetSuite Offers Key Features For Healthcare Businesses Where QuickBooks Doesn’t

Financial management isn’t the only key function for healthcare businesses like yours, by a long shot.

Other functions such as inventory and recordkeeping are just as key to their success, due to the nature of the products and services in the healthcare industry.

And QuickBooks, being purely an accounting solution, lacks the functionalities to manage most of them without third-party solutions or add-ons.

However, as a true cloud ERP software, NetSuite offers a comprehensive business management suite which can be customised to handle the unique industry needs of healthcare businesses like yours.

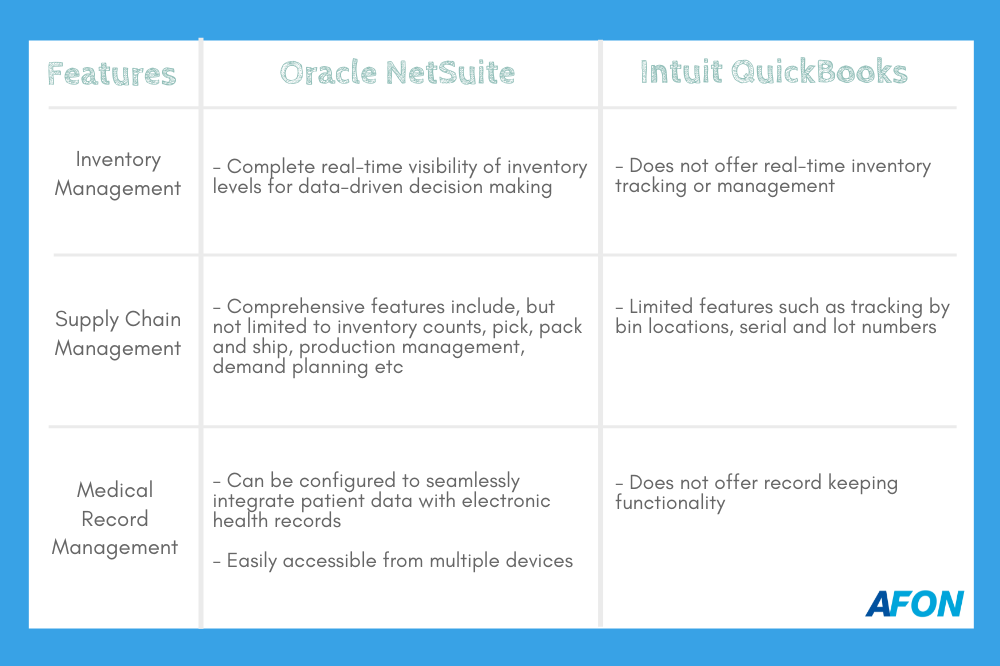

Here’s a comparison between NetSuite and QuickBooks, when it comes to other features and functionalities that are top priority in the healthcare industry:

NetSuite makes inventory management easy with automated, real-time tracking of inventory levels, orders and sales throughout the inventory lifecycle of your healthcare business. This provides the visibility and insights needed to inform data-driven decision-making processes that contributes to the success of your business.

Its supply chain management (SCM) capabilities include inventory counts; pick, pack and ship; integrated barcoding and multi-order picking. In addition, NetSuite also comes with additional SCM features such as production management, demand planning, shop floor control and BOM maintenance amongst others.

Last but not least, NetSuite can serve as a suitable repository for managing the medical records of your healthcare business, as it can be configured to seamlessly integrate patient data with electronic health records that’s easily accessible from multiple devices. This allows your medical personnel to access the relevant data at any time, whenever it becomes necessary.

In the case of QuickBooks, it does not offer real-time inventory management or record keeping, and only limited SCM features such as tracking by bin locations, serial and lot numbers.

Healthcare Businesses Should Upgrade From QuickBooks To NetSuite ASAP

%20(1)%20(1).jpg?width=1000&name=national-cancer-institute-NFvdKIhxYlU-unsplash%20(2)%20(1)%20(1).jpg)

As can be seen in the above comparisons, Oracle NetSuite brings a straight upgrade to the table for healthcare businesses like yours, when compared to QuickBooks.

Not only does it come with a more robust set of financial management features, the nature of NetSuite as a true cloud ERP software means it also comes with other features and functionalities critical to the functioning of your healthcare business.

This is something that QuickBooks, being a basic accounting software, can never match NetSuite in.

Because of this, it’s best to upgrade your healthcare business from a basic accounting software like QuickBooks, to an ERP software with a more comprehensive set of business management functions such as NetSuite.

Only then will the growth of your healthcare business no longer be hampered by the limitations of QuickBooks, allowing it to pursue greater success with the flexibility and scalability offered by NetSuite.

To see examples of growing businesses that have dropped QuickBooks in favor of NetSuite to accelerate their growth rate, click on the image below.