The message behind Budget 2026 is clear: Adapt or be left behind. Delivered against a backdrop of global economic shifts and rapid technological disruption, this year’s fiscal roadmap is defined by a 'Triple-A' strategy that is made up of AI adoption, Accelerating internationalization, and Addressing cost pressures.

Whether you’re a lean start up looking to scale or an established SME grappling with rising manpower costs, Budget 2026 offers a suite of tools designed to transform current challenges into competitive advantages. Here is everything you need to know to stay ahead of the curve.

*Please note that information is subject to change and will be updated as government agencies release further details.

1) The First A: AI Adoption as The New National Mission

Prime Minister announcing the launch of National AI Council to accelerate transformation; Source: CNA

The government is moving beyond AI awareness to AI execution, launching sector-specific "National AI Missions" for Advanced Manufacturing, Connectivity, Finance, and Healthcare. The goal is to ensure Singapore remains a global leader in high-value services.

%20(1).jpg?width=1000&height=1250&name=fy2026_infographics_harnessing-ai-strategic-advantage%20(1)%20(1).jpg)

Overview of government initiatives to support AI adoption; Source: Government of Singapore

Key Support & Grant Boosts

- Champions of AI Program: A new initiative to help selected companies scale AI across their operations through tailored guidance and workforce training. It aims to help firms move beyond pilot projects to full AI integration, boosting productivity and setting industry benchmarks.

- Enterprise Innovation Scheme (EIS) AI Booster: For YA 2027 and YA 2028, businesses can claim a 400% tax deduction on up to $50,000 of qualifying AI expenditure, effectively lowering tax burden for companies investing in R&D or data readiness.

- Productivity Solutions Grant (PSG) Expansion: To make AI accessible, the PSG now includes a wider range of AI-enabled tools. This is the primary vehicle for SMEs to adopt "plug-and-play" technology (like AI-driven inventory or customer service tools) with up to 50% co-funding support.

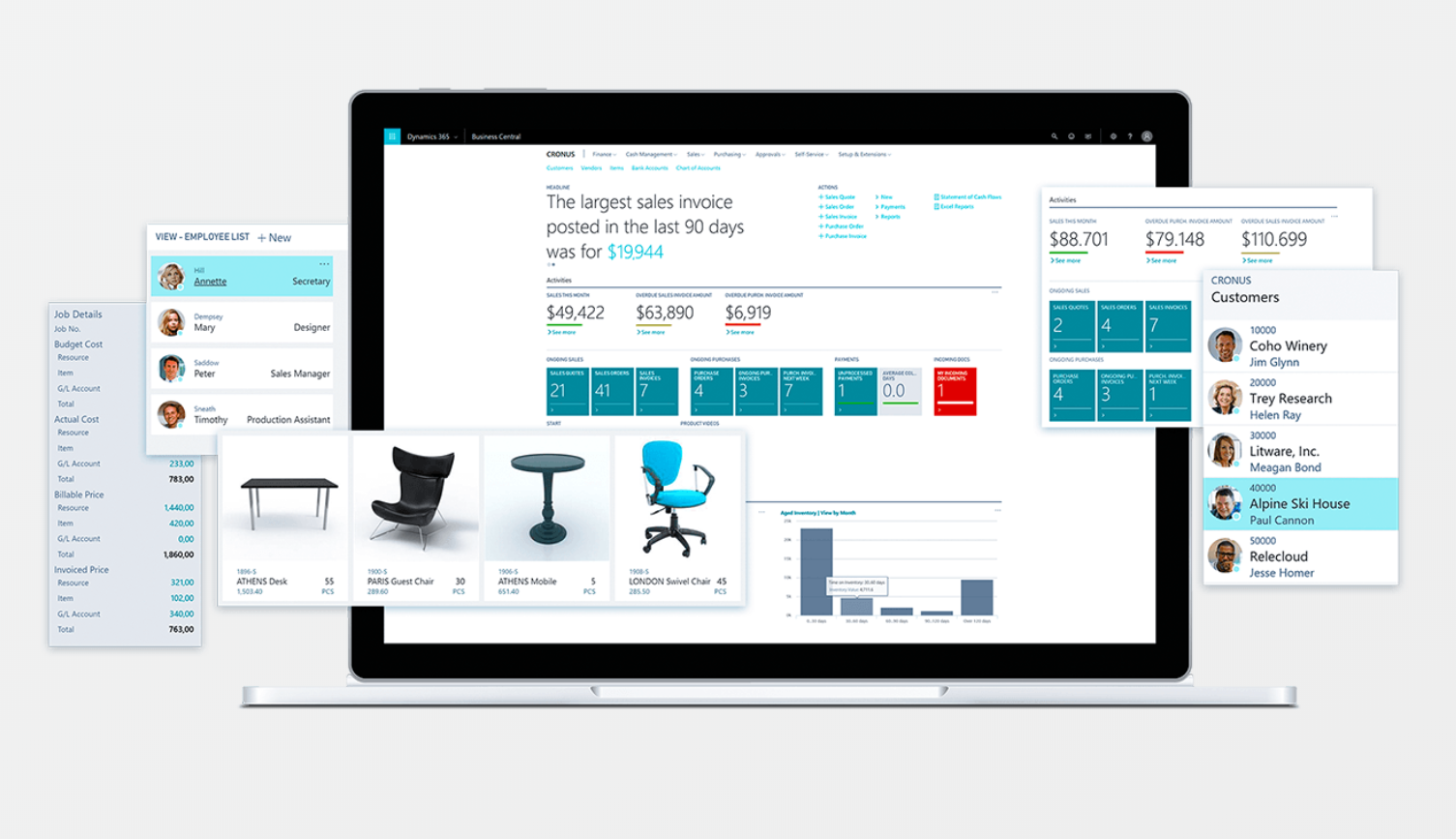

Since AI capabilities are increasingly integrated into major ERP systems, the most efficient way to "adopt AI" is often through upgrading your core business software. As a pre-approved PSG vendor, AFON specializes in helping businesses deploy these solutions from Microsoft Dynamics 365 Business Central (with its built-in Co-Pilot) to SAP Business One. Explore our PSG packages today to see how you can leverage Budget 2026 to modernize your operations.

2) The Second A: Accelerating Internationalization

With domestic growth facing physical constraints, Budget 2026 incentivizes businesses for oversea expansions, particularly within ASEAN and emerging economies.

%20(1).jpg?width=1000&height=1250&name=fy2026_infographics_advancing-refreshed-economic-strategy%20(1)%20(1).jpg)

Overview of available support for businesses scaling up/expanding oversea; Source: Government of Singapore

Key Support & Grant Boosts:

- Market Readiness Assistance (MRA) Grant Boost: helps cover costs for market promotion, business development and market set-up. Co-funding for SMEs is increased to 70% (up from 50%) until March 2029. Additionally, the grant now supports deepening activities in existing markets, allowing you to scale up where you already have a foothold.

- Enhanced Business Adaptation Grant: helps local enterprises impacted by tariffs to adapt their business operations and strengthen supply chain resilience through advisory and reconfiguration support. From 1 April 2026, local SMEs will receive support of up to 70% of eligible costs and local non-SMEs will receive support of up to 50% of eligible costs until Oct 6, 2027.

- Enhanced Global Innovation Alliance schemes: support Singapore-based start-ups in expanding overseas through network of Singapore and oversea partners. From 1 April 2026 till 31 March 2029, local SMEs will receive up to 70% of eligible costs and up to 50% for non-SMEs.

- Double Tax Deduction (DTDi) Enhancement: The cap for automatic tax deduction claims (no prior approval needed) jumps from $150,000 to $400,000 for YA 2027, covering more activities like investment feasibility studies and overseas business development trips.

- Enterprise Financing Scheme (EFS): Loan limits for trade and fixed assets are enhanced, with an overall loan exposure limit of $50 million per borrower group to support large-scale international projects.

3) The Third and Final A: Addressing Cost Pressures

Support measures to help companies stay competitive amid cost pressures; Source: CNA

Recognizing the immediate pressure of inflation and rising wages, the government is providing various support initiatives to relief the cost pressures that businesses face.

Key Support:

- Corporate Income Tax (CIT) Package: A 40% CIT Rebate for YA 2026, plus a $1,500 Cash Grant for active firms with at least one local employee. Total benefits are capped at $30,000.

- Progressive Wage Credit Scheme (PWCS) Boost: more support for employers navigating higher wage costs for lower-wage workers. Some measures include raising Local Qualifying Salary (now $1,800), with government co-funding for 2026 wage hikes raised to 30% (up from 20%).

- Energy Efficiency Grant (EEG) Extension: The EEG is extended to 31 March 2027, offering up to 70% support (capped at $30,000 for base tier) for SMEs, and 30% support for non-SMEs to adopt energy-saving equipment to offset the carbon tax hike.

So What's Next?

Budget 2026 isn't just about survival; it’s about scaling up to be AI-ready for tomorrow.

Accelerate Your Digital Transformation

%20(1)%20(1).jpg?width=1000&height=666&name=shutterstock_116283283_1920_compressed%20(3)%20(1)%20(1).jpg)

If you're looking to kickstart your digital transformation journey, now is the time to act. With the variety of support initiatives and government grants like Productivity Solutions Grant (PSG) or the Enterprise Development Grant (EDG) available, businesses should tap on these measures to enhance their core capabilities for long term growth.

With the PSG now expanded to cover a broader range of AI-enabled solutions, businesses get a rebate of up to 50% off qualifying costs. This significantly lowers the barrier to entry for robust systems, providing the 'digital backbone' your business needs to integrate AI smoothly.

Beyond PSG or EDG, there may be other grants available to you depending on the industry your business operates within.

To discover other government grants that could support your business's digital initiatives, click on the image below to find out more.