Source: IRAS

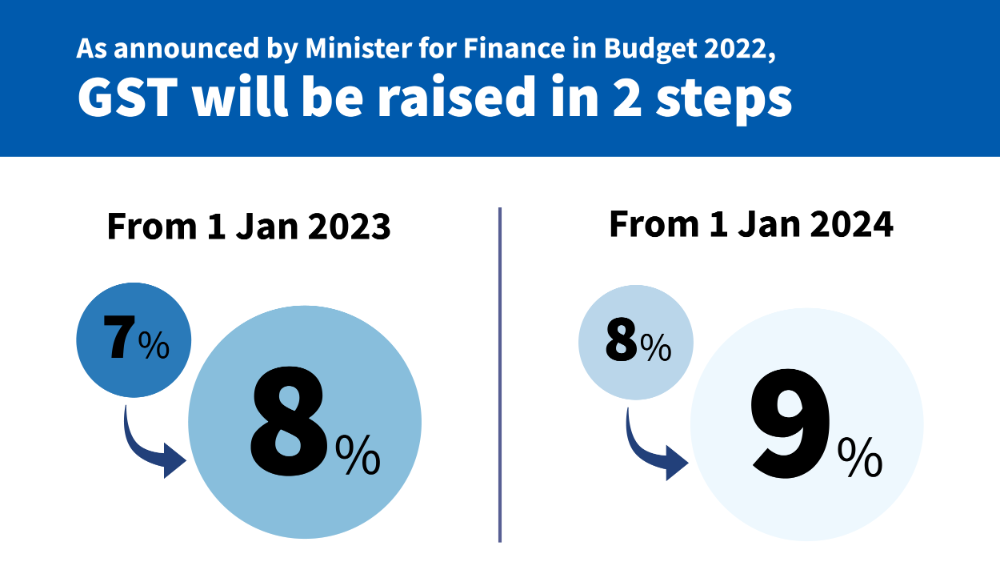

During the Budget 2022 speech by Finance Minister Lawrence Wong earlier this year, he announced that the planned Goods and Services Tax (GST) hike will take effect in two stages; from 7% to 8% on 1 January 2023, with a further planned hike from 8% to 9% in 1 January 2024.

What Are The Highlights Of Budget 2022 For Your Business? Click Here To Find Out.

With 2022 coming to an end, the first of these GST hikes is imminent. And that means GST-registered businesses, like yours, should begin preparing for the transition to the new GST rate next year; failing to do so could incur penalties for your business for non-compliance.

But what sort of preparations do you need to make for your business? The following will serve you as a quick guide to transitioning your business to the new GST rates in the next two years.

What Do I Need To Do To Prepare For The GST Hikes?

First, we advise that you refer to the checklist provided by the Inland Revenue Authority of Singapore (IRAS) to see if your business is ready for the GST hike.

Once you’ve done this, here are the three main preparations you need to make in order to transition your business smoothly to the new GST rates.

1. Updating Your Systems To Use The New GST Rates

You need to make sure that the financial software systems your business is using in day-to-day operations have been updated to the new GST rates, by the time they come into effect.

For next year, that means they must use 8% as the GST rate by 1 January 2023. Some examples of systems which need to be updated accordingly are your accounting or ERP software, invoicing systems, retail management systems, and point-of-sales (POS) sstems.

Check with the vendors or partners of your systems. Some of them will provide self-help materials online, so you can perform the required updates to your systems by yourself. Other systems may be more complex, and require your vendor’s involvement to update to the new GST rate by 1 January.

Do also check with your in-house IT department to find out how they can support a smooth transition to the new GST rate for your business.

2. Update Your Price Displays To Reflect The New GST Rates

You’ll also need to update your price displays to reflect the changes in price due to the rise in the GST rate. These include price tags, price lists, advertisements, publicity brochures, and websites in use by your business.

Any and all prices that are quoted, whether written or verbal, has to be GST-inclusive with the new rates, to ensure your customers know upfront the final price they need to pay for your goods and services.

If you’re not able to change all of the price displays your business is using in time, you may display two prices:

- Prices inclusive of GST at 7% which are applicable before 1 January 2023

- Prices inclusive of GST at 8% with effect from 1 January 2023

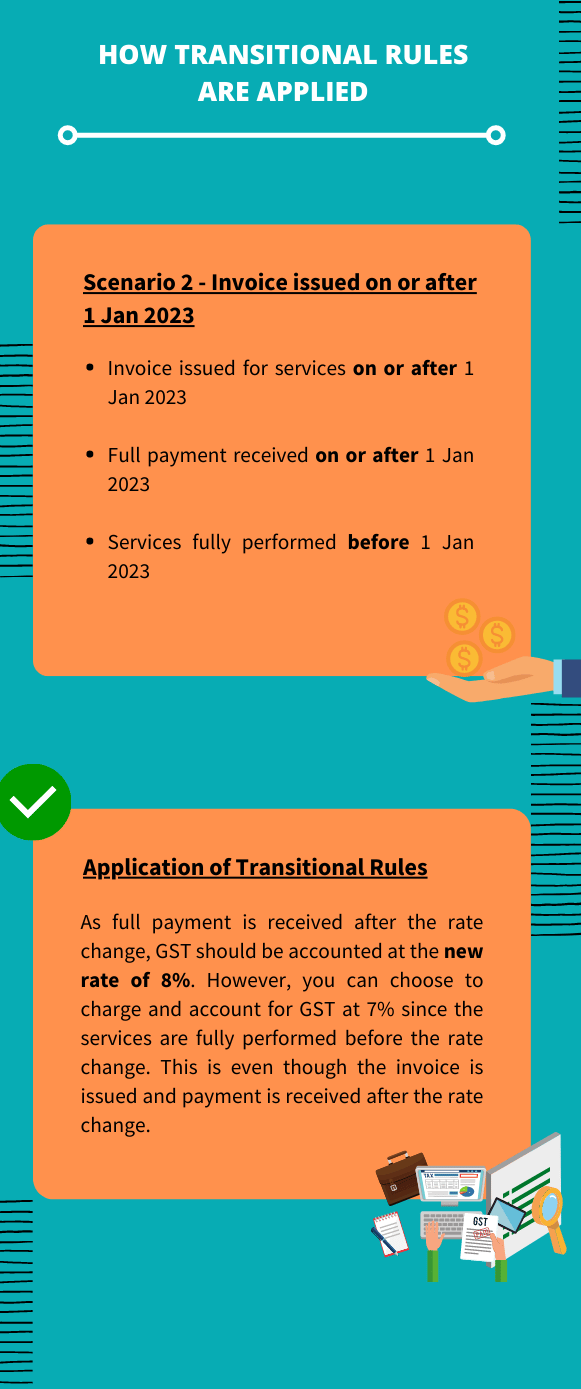

3. Understand The Transitional Rules For The GST Rate Hike, And Apply The Correct GST Rate For Sales Transactions And Reverse Charge Supplies Spanning 1 January 2023

Normally, you’d refer to the time of supply rules when determining when your supply is treated as taking place, when it comes to determining how GST is applied.

During the transition, you should charge GST for your supply at the prevailing rate, based on the same time of supply rules. For example, if time of supply is triggered before 1 January 2023, you should charge GST at 7%.

Conversely, if it’s triggered on or after 1 January 2023, you should charge GST at the new rate of 8% instead.

When it comes to supplies which are straddling the date of the GST rate hike, you’ll need to take a look at the transitional rules to determine whether to charge GST under the old or new rate. Do refer to IRA’s e-Tax Guide, “2023 GST Rate Change: A Guide for GST-registered Businesses”.

Take a look at the infographics below for examples of how these transitional rules should be applied by your business.

Source: IRAS

Source: IRAS

Source: IRAS

Source: IRAS

For more detailed information about how the upcoming GST rate hikes in 2023 and 2024 will affect your business, take a look at the in-depth guide published by IRAS.

How Would An ERP Software Ease Your Transition To The New GST Rate?

One of the most effective ways to manage your business’s obligation to comply with local financial regulations is with a solution that provides financial management functionalities, such as an ERP software.

This is also the case with the upcoming GST rate hike in 2023 and 2024. If you’re managing your business finances with an ERP software, it should provide a way for you to change the GST rate you’re currently using so that sales orders and purchase orders made during and after 1 January 2023 reflect the new rate.

Take Microsoft Dynamics 365 Business Central, for example. It comes with a GST Rate Change tool which allows you to convert GST rates recorded in your master data, journals and orders to an extent.

Using the GST Rate Change tool, you can not only convert the GST rate in your master data more easily, but also do so for orders that cannot be closed before 1 January 2023, and for which the processing period will cross the deadline.

Although the tool has its limitations, this can make it much easier for you to update the GST rate through every part of your business operations, and ensure that sales and purchase orders that are being processed past 1 January 2023 will reflect the new GST rate and keep your business in compliance.

To find out more about the GST Rate Change tool in Business Central, and how you can set it up and perform the conversion with it, refer to this page.

Of course, an ERP software can do much more for your business than simply convert the GST rate across all of your sales and purchase orders. It achieves this by unifying all the data generated and stored in every part of your business, which gives you a single source of truth into your business data and processes.

This means that it's not just the GST rate alone; changing any financial information in your ERP software means that the change is reflected across all of your business processes from end to end.

No matter where and when financial data is updated within your ERP software, any changes are reflected across the board, ensuring that you always have access to the most up-to-date single source of truth.

AFON Provides Pre-approved PSG Packages For ERP Software From Major Brands

Implementing a new ERP software can offer a wide range of benefits for your business, and one of these is that it can greatly ease the transition to the new GST rates for 2023 and 2024.

By using an ERP software to convert the GST rate in your master data, you can more easily comply with record-keeping and other tax obligations after the GST rate hike.

But if you need more funds to acquire such a solution for your business, the Productivity Solutions Grant (PSG) can provide what you need for your first implementation project.

And as an award-winning partner and vendor for several major brands in the industry, AFON is happy to offer you our pre-approved PSG package for ERP software such as Microsoft Dynamics 365 Business Central.

Otherwise, if you’re trying to find out what other government grants your business may be eligible for, take a look at our guide to government grants that can power your business’s digital transformation efforts by clicking the image below.