Closing cycles can be an absolute nightmare in the finance department.

A survey by FloQast showed that 60% of people working in the finance department find their stress levels rise during month-end close. Another 75% of them lack confidence in the accuracy of their numbers.

But it doesn’t have to be this way.

According to one PricewaterhouseCoopers report, great finance functions share the following characteristics compared to average ones:

- Spend 17% less time collecting data

- Spend 25% more time analysing data

- Cost 40% less to run

- Churn out forecasts and budgets in lesser time

Great finance functions also avoid overburdening the business with excessive controls, preferring instead to have controls that are integrated and automated.

So how can you turn your finance function from bad to good, or good to great?

There are many factors contributing to a highly effective team. These range from leadership styles and talent acquisition / management strategies, to “hard” factors like having the right business management system and processes in place.

Because it’s easier for finance teams to focus on changing what’s within their purview (as opposed to say, HR matters), we’ll focus on addressing the systemic aspects in this article.

To get started, here are five steps you can try to build a more effective finance team:

Step 1: Identify Existing System "Hairballs" and Process Bottlenecks.

Before fixing anything, you need to locate where the crux of the issues exists.

Most finance managers find this first step challenging, as there are many work stages in the job functions within the finance department. Perhaps you might think you’ve identified an inefficient closing process, but in reality this may be due to earlier work processes such as data entry or data organisation.

Generally, you can sum up inefficiency causes into two categories:

- Process bottlenecks

- System “hairballs”

A bottleneck occurs when a work step has reached maximum capacity. It gets more work requests than it can handle even at its maximum work rate.

As a result, there’s a system hold up which delays the flow of work to proceeding steps.

It’s the reason why symptoms (overflow of work and stress) of a bottleneck only show up at the very end of the entire work process, leaving you piled with work every closing.

Signs of Process Bottlenecks

- Increased financial & administrative expenses – high transaction volume

- Increased time to generate financial statements

- Late in generating management & tax reports

- Increased errors in financial reports

- Untrained staff, unable to carry out job functions efficiently

System “hairballs” on the other hand, are a bit more challenging to spot.

As a company expands, new systems and work processes are required to support new business functions.

Over time, as more systems are added to support business functions, your inter-department processes become disparate or loosely connected – the exact opposite of an integrated, efficient system.

You’ll end up with repeated work done in separate systems, which robs your department of valuable resources and time to do work that is already done.

And when your team’s compiling reports, it’ll cost you additional time and labour to retrieve information from multiple systems.

Signs of System Hairballs

- You encounter double entry or repeated work

- Have difficult retrieving the information you need.

- Entanglement in backend data organisation.

- Having multiple systems and software.

Step 2: Conduct a Process Workflow Analysis

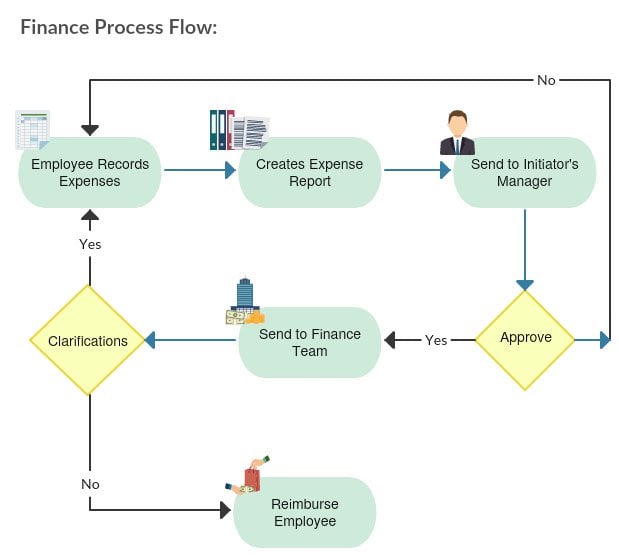

This is what a simple process map might look like. Source: KissFlow

Once you are aware of the causes behind an inefficient process, creating a process map will help you identify them.

Process mapping is a workflow diagram to help you list out all your steps required to execute different business outcomes and the relationships between parallel processes.

If your result is a management or financial report, list down all the work steps involved to generate the report. From data entry, all the way to the final steps required.

A well-drawn process map can help us identify repeated work in different workflow processes – spotting system hairballs. You can then streamline them later on to achieve a more efficient system.

Process mapping will provide you with a detailed breakdown of each work step to achieve your business outcome. Use it as a reference when identifying bottlenecks.

Analyse the workflow from the very beginning to the end, following the flow you have listed in your process map.

The first work process that has the most accumulation of work is usually the bottleneck. Run this analysis throughout all your work processes and take note of them.

If you feel inexperienced in creating a useful process map, engaging a professional consultant or solutions provider can be well worth the money. An experienced consultant can help you identify well-concealed bottlenecks and system “hairballs”.

Step 3: Find a Suitable Enterprise Resource Planning (ERP) System

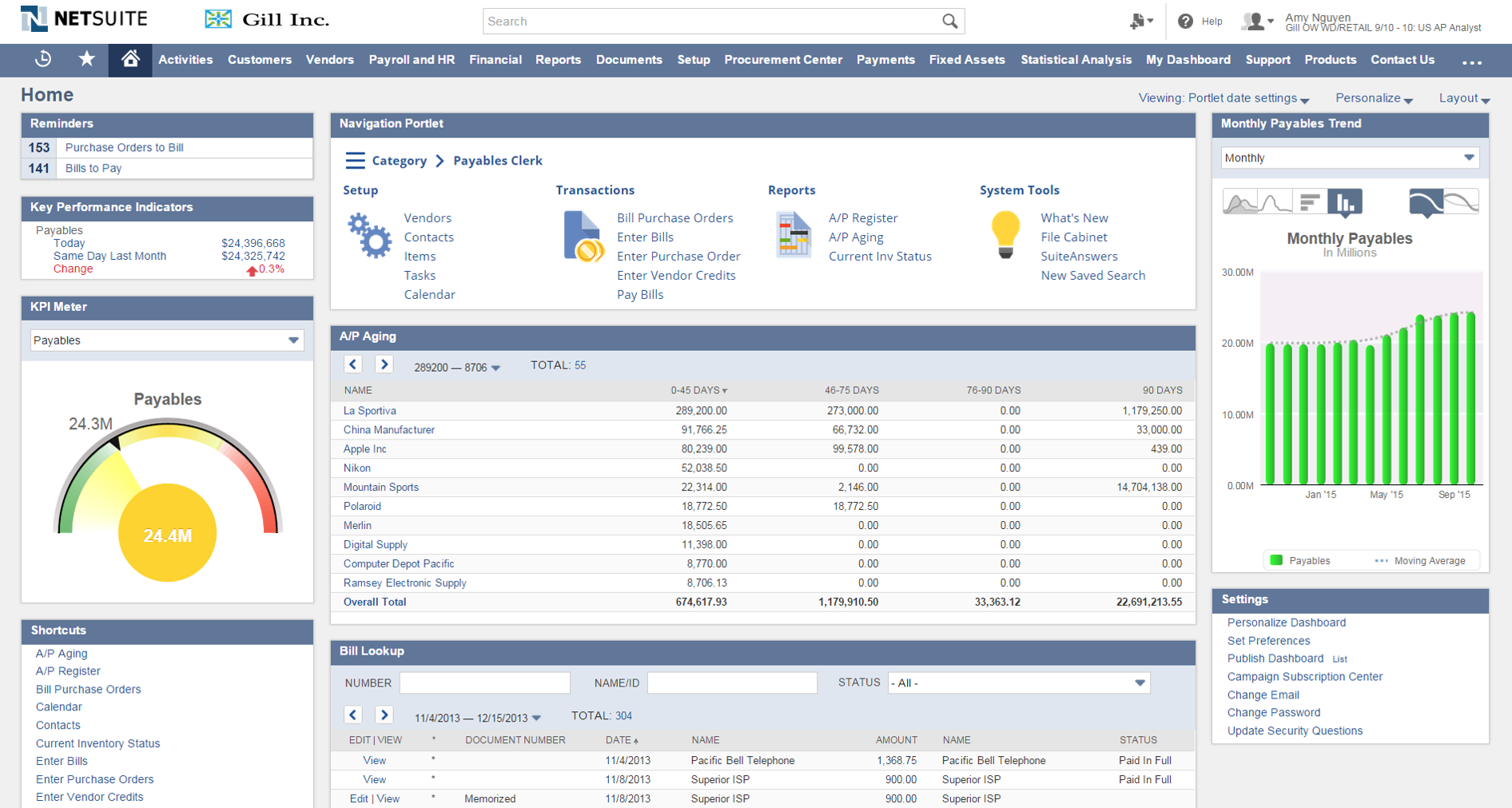

NetSuite's customisable dashboards gives you a high-level overview of key metrics that you can drill down into.

To solve process bottlenecks and system “hairballs”, you’ll need to increase your capacity and integrate disparate processes together seamlessly.

An enterprise resource planning (ERP) system is designed to do just that.

When implemented correctly, a good ERP system fully integrates your cross-company functions and boosts process efficiencies with real-time data-driven insights.

A modern ERP system like Oracle–NetSuite or SAP Business One will also:

- Give you accurate forecasting and realistic estimates

- Improve inter-department collaboration

- Grow alongside your business, with its scaleable architecture

- Integrate data across multiple platforms for consistent, up-to-date information

- Help you respond to complex requests quickly with easy, customisable reporting

- Improve regulatory compliance, and so forth

New to ERP? Download your free Ultimate ERP Guide here.

Or try our online ERP needs assessment and get instant results.

Step 4: Develop an Implementation Plan and Align Your People With New Processes

Besides conducting system analysis and choosing a suitable ERP system, there are two vital elements towards successful implementation:

- Knowing the resources/time required

- People management.

Before implementing a system, you need to know the manpower you’ll need to liaise with vendors, test the system, and so on.

Give yourself a realistic timeframe for the project. Have your consultants provide you with a Gantt chart. Ask your consultants to provide you with a track record of a similar project they have undertaken. A proven track record would give you a more realistic timeframe.

You’ll also face organisational resistance when implementing a new system. Offer your team assurance; let them be part of the project process.

Allow your team to communicate the difficulties they face in the existing system and take their inputs during the project. People tend to accept something when their contributions are considered seriously.

Motivate with the promise of better roles after the new system is implemented and reward individuals who are willing to accept and learn new processes.

Ensure your ERP consultants provide you with adequate training support to your team. Good training will help with a smooth transition to a new system.

Step 5: Evaluating Progress and Objectives

Time is required for your processes, software and end users to get well acquainted with each other. It takes care, time., and effort to perfect a new system.

As you familiarise yourself with the system capabilities, take time to think about how an ERP system could be applied to enhance your job. You will invariably have excess capacity and resources. Think of how to use them.

For instance, are there any particular key performance indicators (KPIs) or financial ratios you want on your dashboard which would facilitate coordination and decision making?

Continue to monitor and seek out areas to be improved. You can do so by conducting a post system analysis similar to step 2. A second system analysis after the new system is set up will help you check if the bottlenecks and “hairballs” have indeed been removed.

You Can Run Your Finance Team Better

In summary, when you take the time to identify and fix system and process inefficiencies, your finance team can work smarter, not harder. Instead of spending their time and energy on tedious accounting processes, you're also freeing them up to add more value to your business.

And when you invest in an ERP system for that reason, you're in a much stronger position to run your finance team better.