Get email updates

Receive great industry news once a week in your inbox

Get email updates

Receive great industry news once a week in your inbox

Get email updates

Receive great industry news once a week in your inbox

Get email updates

Receive great industry news once a week in your inbox

Get email updates

Receive great industry news once a week in your inbox

Get email updates

Receive great industry news once a week in your inbox

Read this free guide to find some stand-alone tools, add-ons, and accounting and ERP software with the relevant features for all your financial reporting needs.

In a perfect world, finance leaders of small to mid-sized enterprises (SMEs) would have complete confidence in their financial statements.

They could trust the numbers to make intelligent estimates of the current and future cash flows and how to manage their inventory levels with minimal wastage. Consequently, they could make smart, timely decisions that bolster their go-to-market strategy, even in tough times.

Unfortunately, that’s not what happens in many SMEs in Singapore.

Here Are 5 Proven Steps To Take If You Want To Build A Finance Department That's Highly Effective.

If you’re spending a lot of time manually compiling reports, that’s a sign you need to rethink those processes.

You might need a specific tool or an add-on to your business’s current solution that could serve the same purpose.

Alternatively, you might be thinking it’s time for an upgrade that will scale with your business’s growing needs.

In all these cases, AFON IT has put together a list of financial, reporting, and inventory tools that can present the data you need in automatically generated reports.

We’ve categorised them into;

We've also included several ERP system suggestions, in case you're searching for a more powerful, integrated system for your organisation.

Without further ado, let’s take a look at some of these tools.

Cash flow statements help you determine the flow of cash within your business by extrapolating on past data, which in turn helps ensure that your business has sufficient liquid funds to fulfil its existing obligations.

But that’s not all they’re useful for. Unlike profit/loss statements, cash flow statements also provide companies in Singapore with pertinent details of where the cash is spent – such as operations, investments, and financing.

How Do You Ensure That Your Business Can Generate A Healthy Cash Flow? Click Here To Learn More.

With the data from cash flow statements, you can discover avenues for creating excess cash, compare planned with actual expenditures, recognise if your business has an excess or shortage of liquid funds, and identify key changes you need to make to your business processes in order to improve your business’s financial positioning.

For this reason, cash flow management tools are essential as they give you real-time data on the movement of liquid funding within your business.

These tools automatically generate cash flow statements in less time than it would take for manual reporting. They also ensure that the data you derive from these statements accurately reflect the reality of your business’s cash flow.

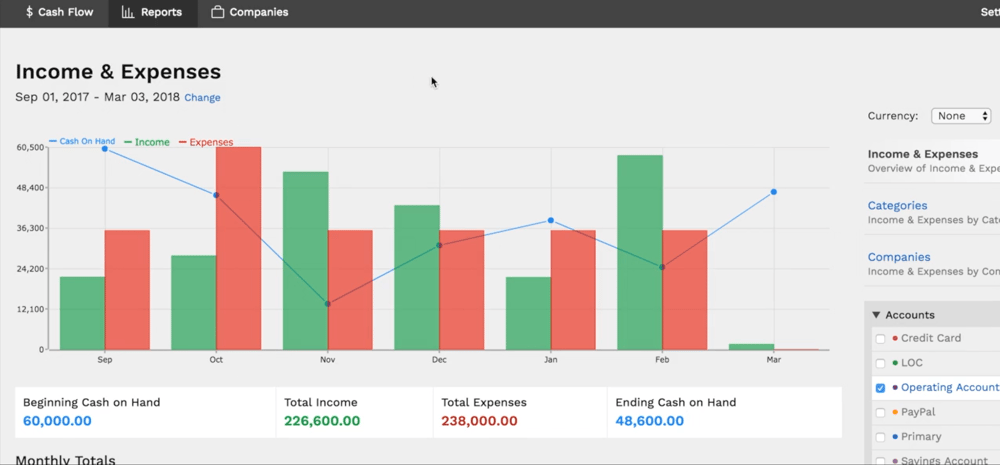

A dedicated cash flow management app that can connect and import data from QuickBooks, Pulse allows you to monitor the cash flow in your business periodically (whether daily, weekly or even monthly).

Pulse is especially useful for small businesses that do business internationally, as it can track cash flow and generate visual reports in multiple currencies.

Apart from cash flow monitoring, Pulse also tracks your business’s income and expenses, and generates reports automatically. A particularly useful feature of Pulse is the ability to forecast the impact that future projects, clients or expenses will have on the cash flow of your business.

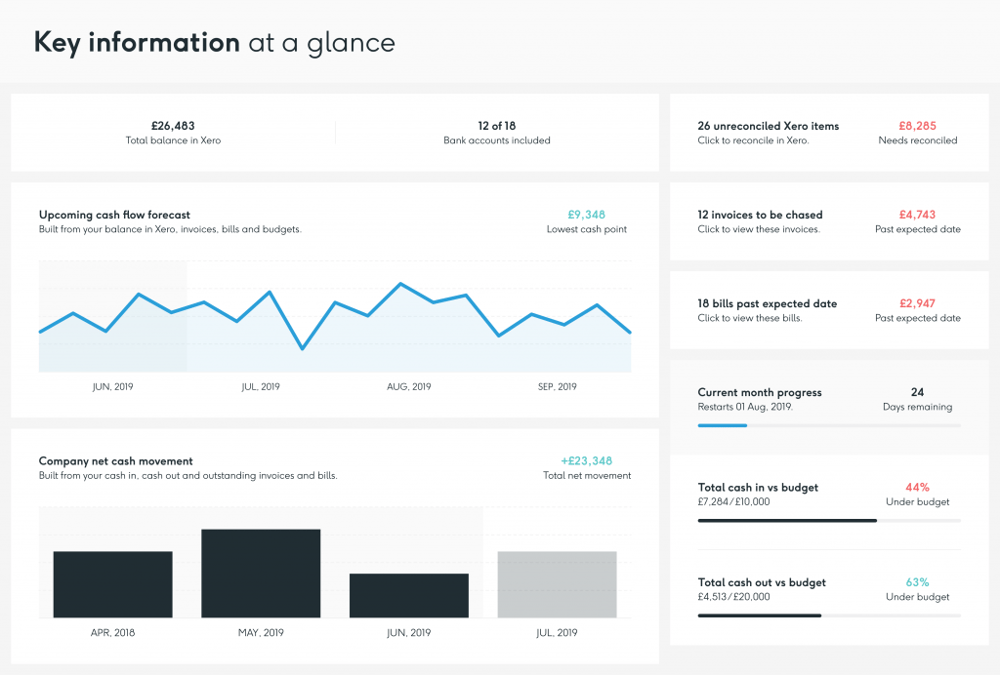

An online cash management and forecasting application, Float can forecast your business’s cash flow years into the future. This keeps you informed not only of your business’s current financial state, but also lets you know how profitable it will be based on current cash inflows and outflows.

You can integrate Float with some of the leading accounting software in the Singapore market, such as QuickBooks and FreeAgent. Float pulls data from your bank accounts by syncing with your accounting software and uses it for reporting cash flow forecasts to you in real time.

Apart from forecasts, you can also use Float to create multiple scenarios for modelling your business’s short- and long-term cash flow, helping you manage your expenses and stay prepared for contingencies.

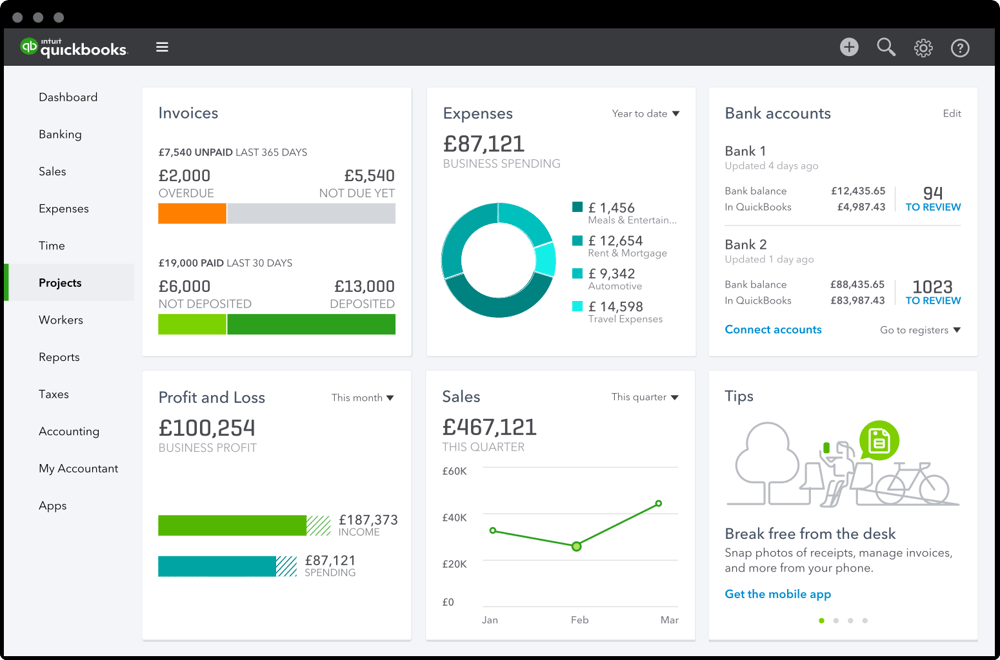

One of the most popular accounting software in the market, QuickBooks offers a cash flow forecast feature. This feature models your cash flow up to one month ahead using data from your receivables, accounts payable and bank accounts. It is also available as a cloud-based platform, QuickBooks Online.

Besides this, QuickBooks comes with its Cash Flow Projector tool. This tool lets you input data manually to get an overview of your business’s cash flow for the next six weeks and adjust the data to preview how your cash flow will change in certain scenarios.

QuickBooks is more suitable for small businesses in Singapore with simple cash flow management and reporting needs. However, due to its popularity, many dedicated cash flow management apps, such as Pulse, are designed to integrate with QuickBooks.

Therefore, users of QuickBooks have lots of options to further extend the software’s cash flow management functionalities if they find it’s necessary for their business needs.

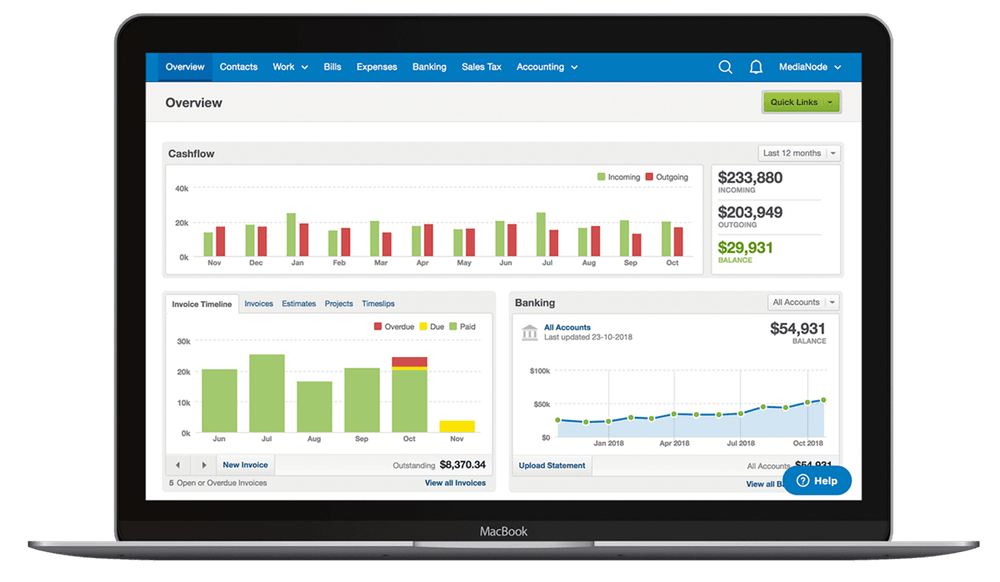

Designed for freelancers, small business owners and accountants in Singapore, FreeAgent is an online accounting software that helps you get a clear overview of your firm’s finances. It automates your invoicing processes, tracks your expenses, gives you a bird’s eye view of your project activity, and synchronises with your bank accounts to track your transactions.

FreeAgent provides a dashboard where all of the aforementioned data is presented, giving you a real time view of your business’s financial health.

This includes a cash flow view which provides monthly reporting of your cash inflows and outflows, as well as a live profit and loss snapshot view that lets you know how profitable your business is at a glance.

Modern enterprise resource planning (ERP) systems come with a comprehensive set of features for integrating multiple departments and functions. This makes them ideal for managing every aspect of a business’s operations.

Some of the software have especially powerful reporting features for certain types of financial data. Thus, if you’re already looking at an ERP for your business, you may want to consider making your choice based on what you need most.

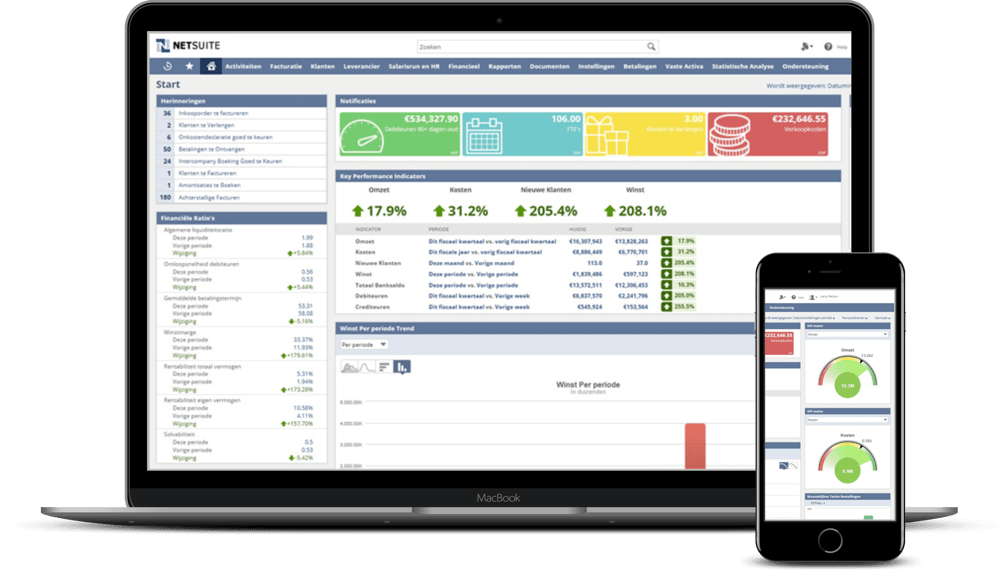

In the case of cash flow management, Oracle’s NetSuite is an especially suitable choice for businesses with subsidiaries in multiple locations.

That’s because it offers more powerful consolidation tools and intercompany auto-elimination functionalities, compared to its peers.

With these functionalities, all data generated by your business and its subsidiaries are consolidated within a single database for easy access.

Your finance function can benefit from these functionalities. This is because they can use them to generate cash flow statements with financial data consolidated from all your subsidiaries within and outside of Singapore.

By removing the need to manually consolidate your financial data, you can save significant time and effort while managing your cash flow.

Business budgeting helps you identify how much capital is currently available, estimate your level of expenditure, and anticipate incoming revenue for your business.

With careful planning, a budget helps firms in Singapore track their business finances, allowing for long-term strategic planning for just about every business aspect. This ranges from recruitment to capital investment, from setting earnings goals to potential expansion opportunities.

A detailed budgeting process enables your business to run regular earnings reporting and provide status updates to your directors and stakeholders. It also helps you adjust your business strategy should unforeseen costs arise.

If your business acquires much of its revenue from seasonal sales periods, budgeting is particularly important for you. This is because it lets you plan ahead, and create an effective strategy of distributing your revenue throughout the fiscal year.

To help streamline the budget planning process, you can use budgeting tools. These help to eliminate manual tasks, automate repetitive routines, keep your books accurate, and enable you to set up notifications to alert you of impending payment deadlines.

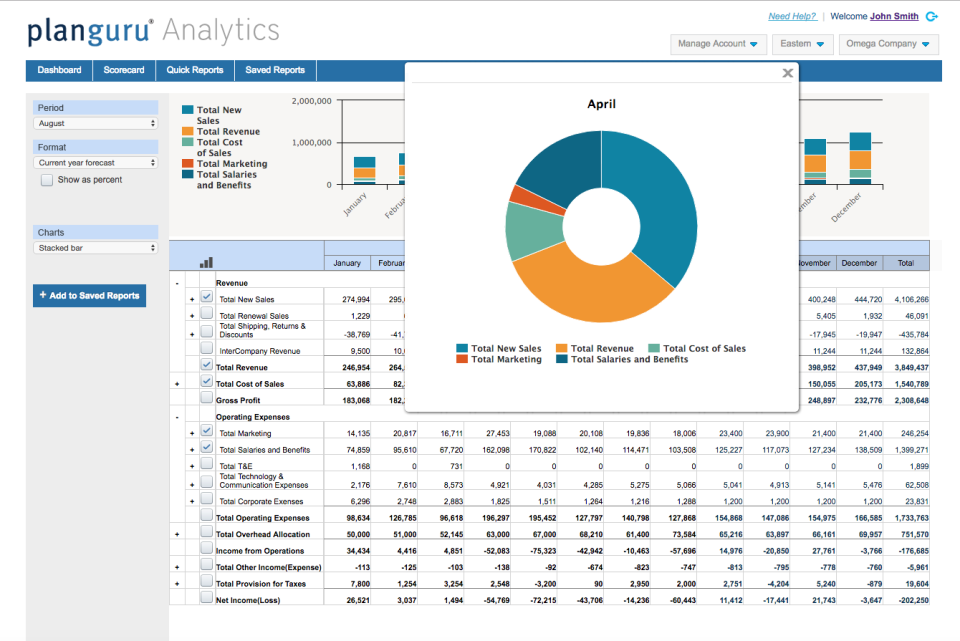

A business planning and budgeting solution for small businesses and non-profit organisations in Singapore, PlanGuru offers no less than 20 forecasting methods. This enables you to project your business’s income statement, balance sheet, and cash flow statement models for up to 10 years.

As a bonus, it can import your business’s financial data through QuickBooks as well as Excel spreadsheets.

PlanGuru also comes with PlanGuru Analytics, a fully customisable cloud-based finance dashboard and reporting tool which allows you to monitor the key financial KPIs that track the performance of your business.

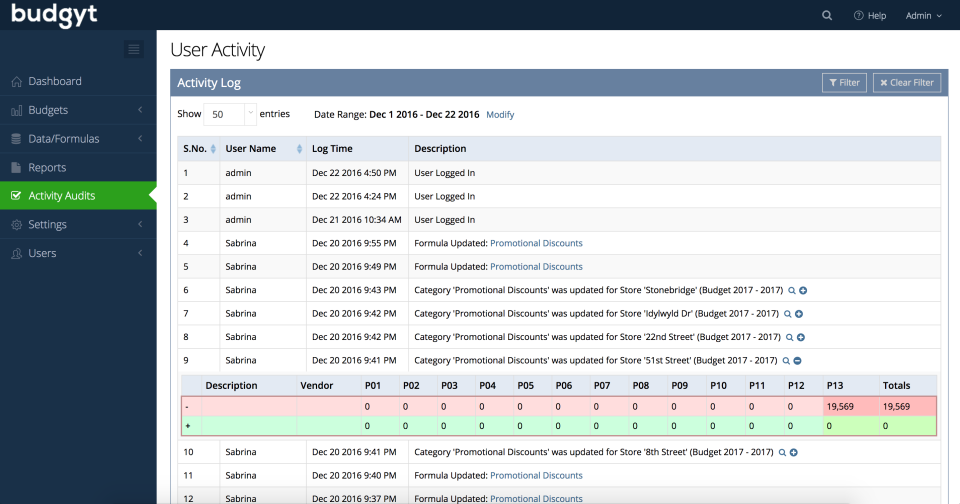

A cloud-hosted budgeting and financial reporting software for small businesses and non-profit organisations, Budgyt is especially user-friendly even for those who are not financial professionals.

Being a cloud-hosted solution, multiple members of your business can work on the same budget simultaneously, and you can preserve data security in your business through user access controls.

Budgyt is designed to replace Excel spreadsheets as a budgeting platform in Singapore, and you can significantly reduce the time spent building your budget through the software.

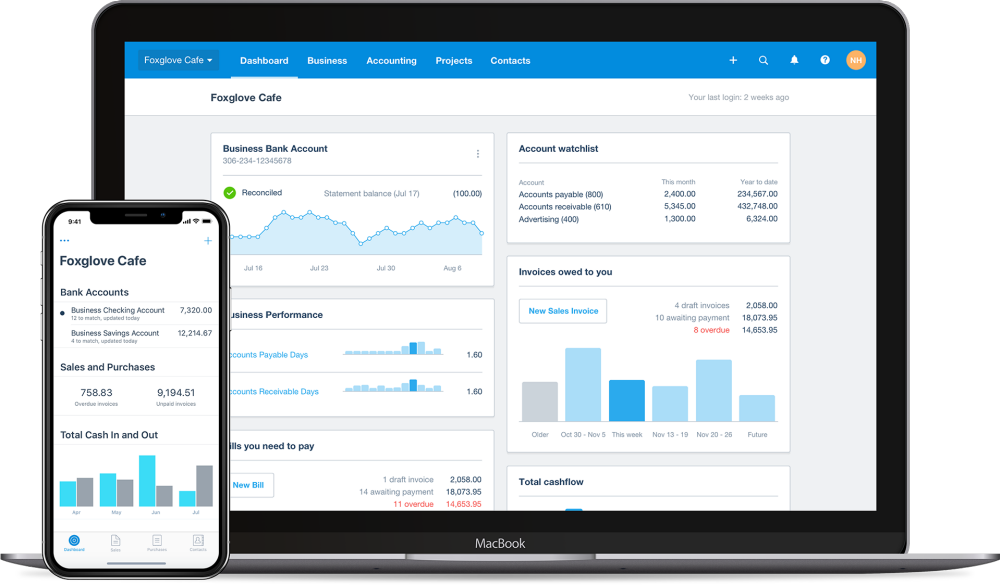

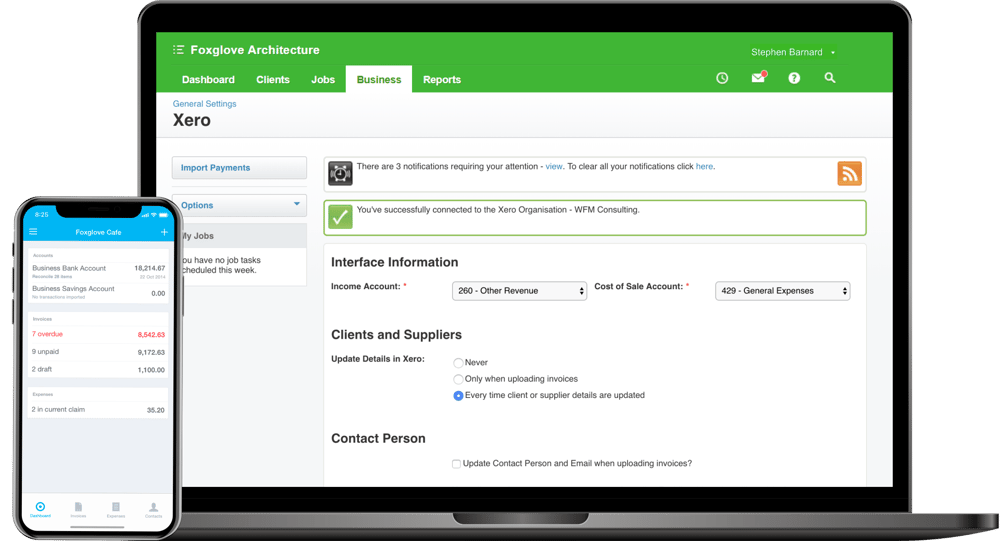

A popular accounting software for small businesses in various industries, Xero packs all the most essential budget management and reporting tools. Boasting a simplified interface, it is designed to be easy for non-finance professionals in Singapore to navigate.

As part of its feature set, Xero offers interactive reports and budgets in real time. This gives you good luck with your financial figures, tailor reports to show the data you’re looking for, and measure specific KPIs for your business.

It’s also easy for you to prepare a detailed budget, import an existing one, or export one to either a PDF file or Excel spreadsheet for your own purposes.

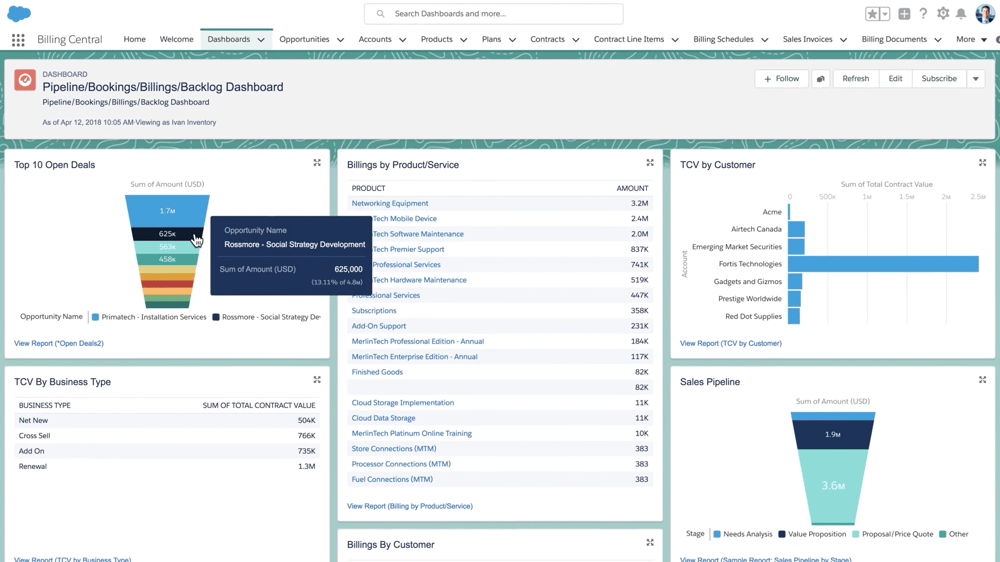

The accounting platform of the cloud-based customer relationship management (CRM) platform Salesforce.com, FinancialForce Accounting is designed to fit the budgeting and reporting needs of Singapore’s SMEs.

Because of its native integration with the Salesforce CRM as well as other Salesforce products, FinancialForce easily consolidates customer transaction records. Additionally, it tracks the impact of these transactions on your business’s bottom line, tying your budget forecasting directly to your sales revenue.

FinancialForce also comes with the General Ledger costing tool, a cost accounting feature that allows you to transfer costs between separate business units. Consequently, this helps you manage shared resources between departments, from advertising to logistics.

If your business offers multiple products and/or services – such as those in construction, manufacturing, and medical services – you must be able to estimate the cost incurred and revenue earned on each project accurately.

Should you fail to account for this, you will experience consequences. This includes losses incurred from taking unprofitable jobs, dissatisfied customers due to billing errors, cash flow shortfalls, and lower-than-expected profits due to unforeseen costs (or profit fade).

But with robust job costing and reporting tools, you can identify which projects are profitable enough to be worth the time and expense. You can also easily figure out where you can afford to cut costs to boost your business’s profitability and provide more accurate estimates to your customers or when bidding for a project.

In fact, the lack of sufficiently robust job costing features is a major reason why many businesses in Singapore find that small-scale accounting software like QuickBooks no longer meets their needs. It is also the reason prompting them to look for a better solution.

Job costing tools can come as standalone solutions or add-ons to accounting software that otherwise lack these features.

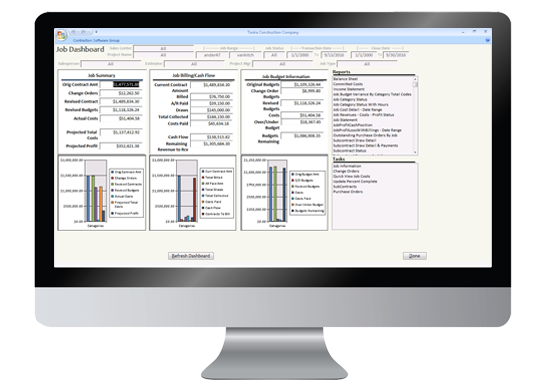

A single-entry construction job cost software and accounting solution, Job Accounting Plus helps home builders and contractors in Singapore handle their job costing, billing, bookkeeping and financial reporting.

Job Accounting Plus comes with an executive dashboard. This effectively provides financial information, job summary, job billing and budget information for every project your business handles.

As part of the Plus Series software from developer Contractors Software Group, you can purchase Job Accounting Plus as a stand-alone application. Otherwise, you can get it as part of an integrated solution with other products, such as Sales Builder Plus, Takeoff Plus and Scheduling Plus.

Construction Partner is a construction accounting and job costing system that combines accounting, estimating and job costing in a single package for small and medium-sized contractors.

Construction Partner comes as a full-featured system with generic accounting capabilities (e.g., accounts payable/receivable, general ledger, payroll). Still, its strength lies in construction-specific capabilities, which include a job costing feature.

Whether your business is a residential, commercial or industrial contractor specialising in fields from earthworks to electrical or plumbing, Construction Partner is designed to meet your job costing needs.

A project management add-on for Xero, WorkFlowMax brings job costing features to the table that caters to the needs of small businesses.

It offers real-time reporting, which lets users determine the profitability of any job at a glance. The Report Builder feature also lets you design your reports, so you get exactly the data you need quickly.

WorkFlowMax also offers one of the best values in job costing software on the market.

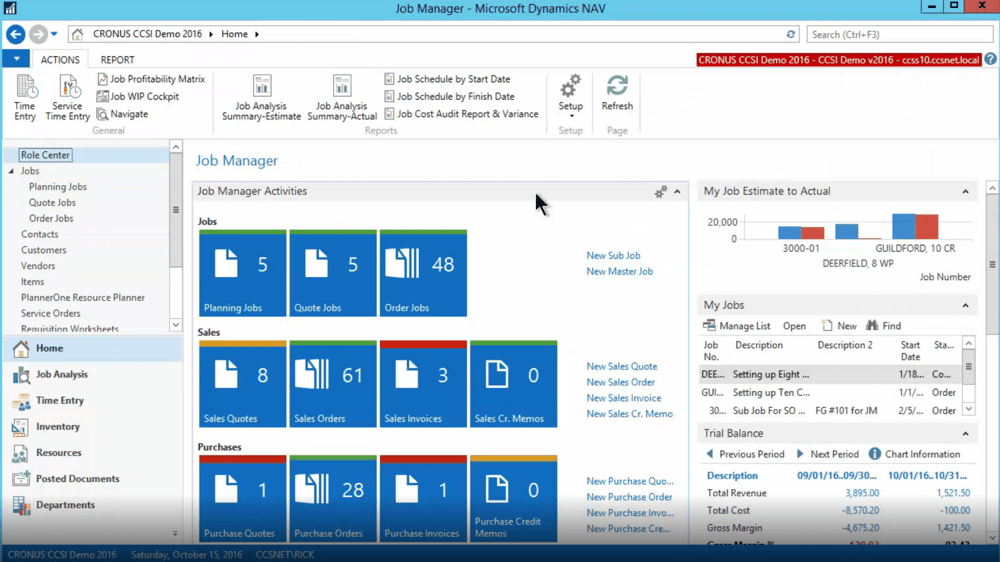

An Activity-based Job Costing add-on for Microsoft Dynamics 365 Business Central, Job Manager is a complete project management and costing solution. This tool helps you manage your resources and track the status of each job.

It comes with key features such as estimating and quoting, labour tracking, and billing functionalities, and keeps you informed with real-time, up-to-the-minute data on where your costs are on every one of your jobs.

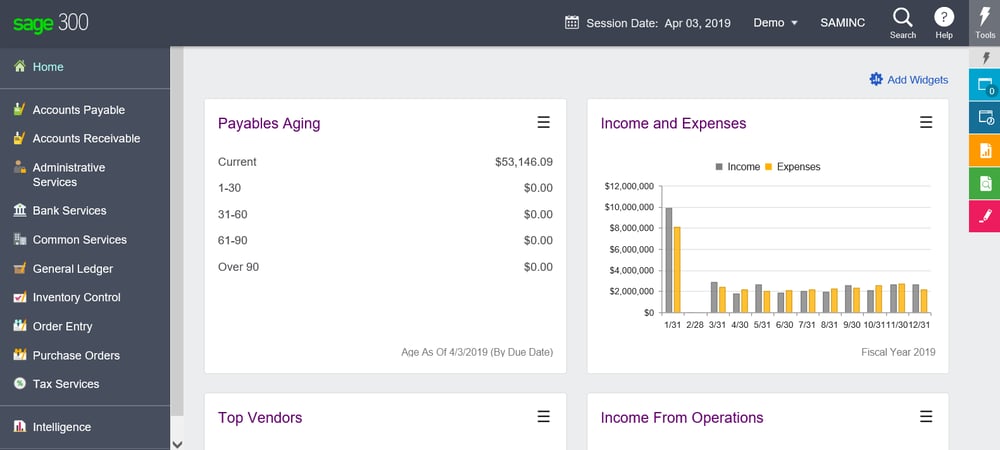

If you’re looking for a robust project job costing feature as part of a fully featured ERP system, you may want to look at Sage 300 ERP.

This is because it has long been the favourite software solution of accounts for several decades, ever since it was known as its previous incarnation, “ACCPAC Plus”.

Sage 300 ERP carries on the legacy of its predecessor by being known for its robust and highly detailed project job costing module. It lets you track a wide range of variables (such as costs, estimates, resources etc.) on multiple projects to ensure they all remain profitable and on schedule.

In fact, the capabilities of Sage 300 ERP’s PJC module outstrip those of many of its fellow Tier I ERP competitors in Singapore, which are much less affordable yet equally limited alternatives.

If you employ a sales force that is always on the move, you would be familiar with the daily expenses that are incurred in the process of closing deals.

Whether your business policy is to provide meal and/or transportation allowances or otherwise reimbursements for the same, these day-to-day costs can add up in the long run and affect your bottom line.

Tracking these expenses can be challenging and time-consuming for you. This is because you’d have to collect and organise receipts, use them to create and verify expense reports, and check these expenses against your budget.

But expense tracking is essential, as it reflects the true cost of doing business. It also gives you a better insight into how you’re managing your money and can help you identify opportunities for cutting unnecessary costs.

Fortunately, there are solutions and tools in the Singapore market to automate the expense tracking process, from receipt tracking to reporting.

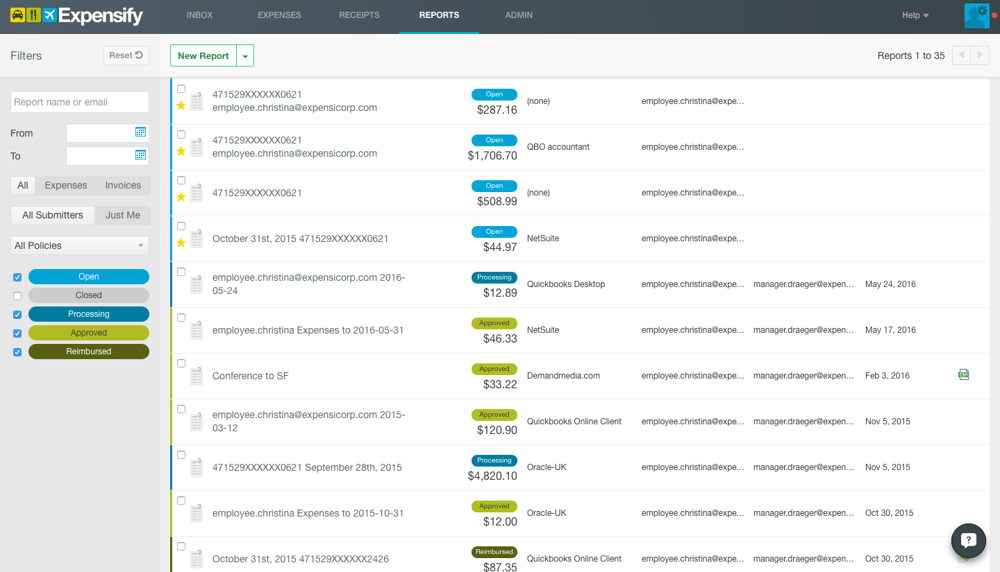

Boasting a comprehensive feature set and automation capabilities, Expensify is one of the top choices for expense tracking in the Singapore market.

It comes with SmartScan technology that allows your employees to scan their receipts, which the system then uses to automatically record and generate expense reports automatically.

You can even customise expense policy rules, which will then automatically review expenses incurred by your employee and flag any potentially unauthorised expenses that need a manual review.

Expensify can be integrated with diverse platforms. These include accounting software such as QuickBooks and FinancialForce, and ERP solutions like Microsoft Dynamics and Oracle’s NetSuite, greatly extending their expense-tracking functionalities.

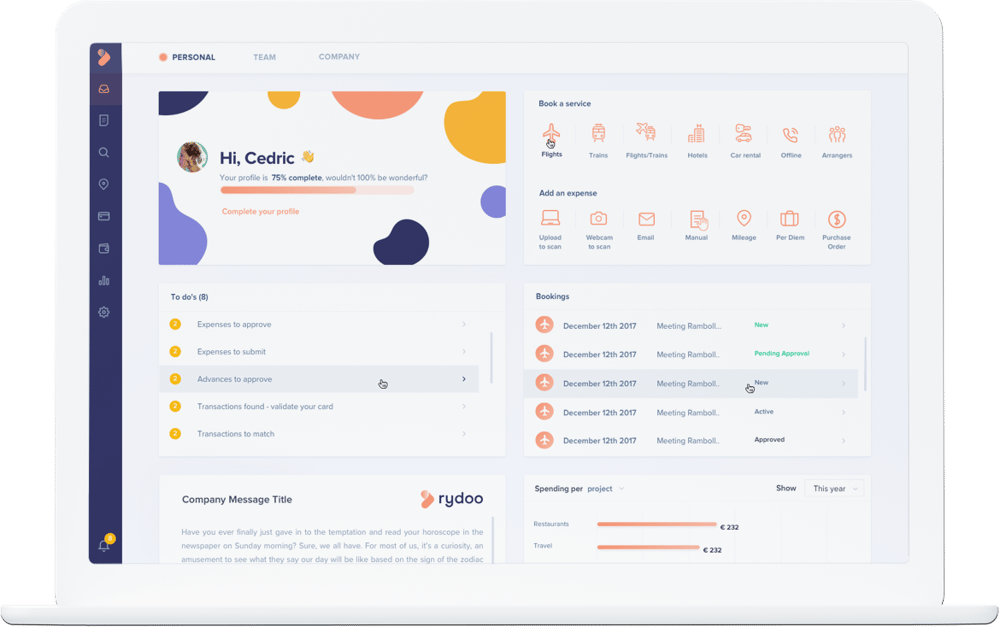

Formerly known as Xpenditure and iAlbatros, Rydoo Expense is an expense tracking solution that automates the expense management process.

Like Expensify, Rydoo Expense allows your employees to scan and upload their receipts, which then automatically creates expense reports. These reports can be exported in a variety of formats including PDF or CSV.

You can quickly secure your approval flow by adding approvers, controllers, and CFOs to the approval process. You can also set detailed compliance rules that apply to your employees for more accurate expense management.

Rydoo Expense’s strength lies in its capacity to integrate with accounting software and some of the biggest names in the ERP market. This includes SAP, Microsoft Dynamics, and Oracle’s NetSuite.

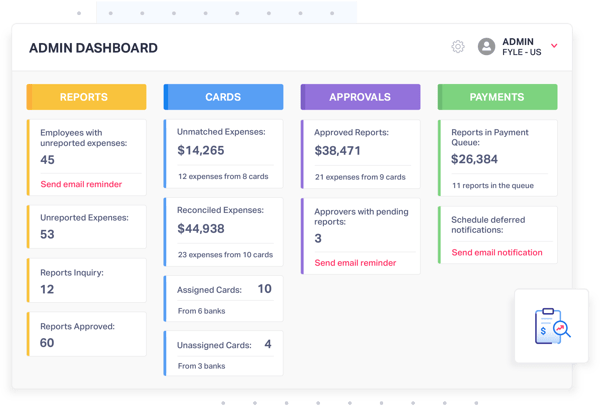

Noteworthy for its innovative expense tracking features as well as its ease of use, Fyle is an AI-powered expense management software that offers enterprise-grade control for Finance teams and administrators. It also affords a user-grade experience for all stakeholders in your business.

Fyle boasts features and tools that eliminate the need for manual input in expense reporting, such as automated reporting, receipt tracking and automatic checks for policy compliance.

You’ll also find that managing your corporate credit cards is effortless with Fyle, thanks to its integrations with multiple vendors, automatic reconciliations, and ease of transaction reversals and refunds.

Fyle can easily be integrated with a number of accounting and ERP software in Singapore, including QuickBooks, Xero, and Oracle NetSuite. It also offers API integrations that allow your developer to build on top of Fyle, facilitating the effortless movement of data in and out of the expense management software.

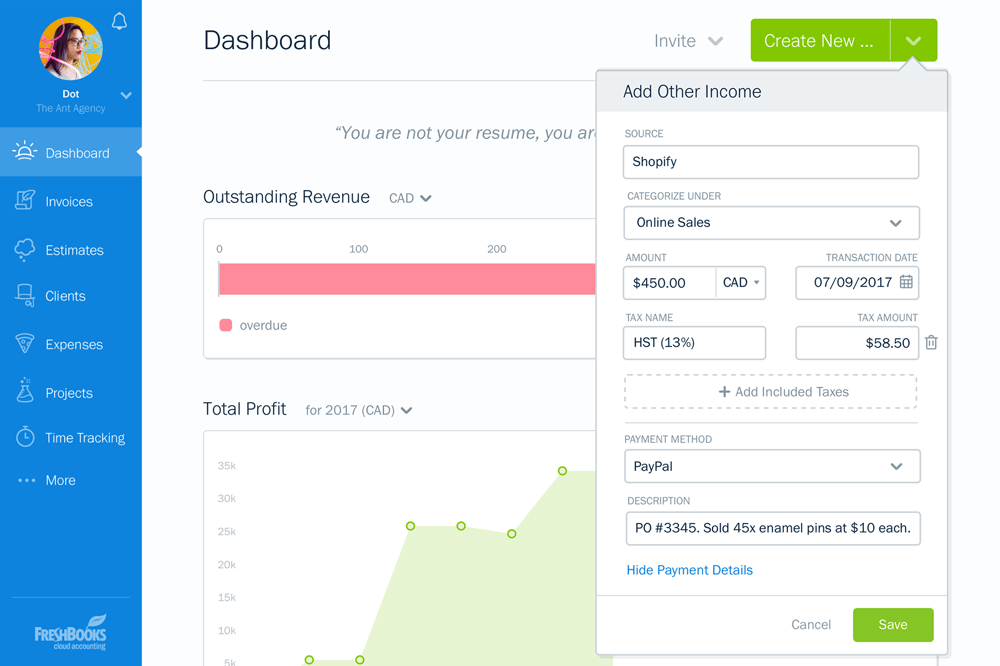

Another popular accounting software solution for small business owners, FreshBooks comes with a robust set of features and capabilities. This includes invoicing, time tracking, and payments management.

FreshBooks is especially notable for its full-featured Android and iOS apps, which lets you access all its essential features as well as your business data from your mobile phone, wherever you are.

These apps also mean that FreshBooks’ expense tracking management is top-notch, as it allows your employees to snap photos of their receipts. It then logs and consolidates all related expense items by employees.

FreshBooks’ expense tracker also lets you monitor your credit card and bank accounts by directly importing your day-to-day transactions.

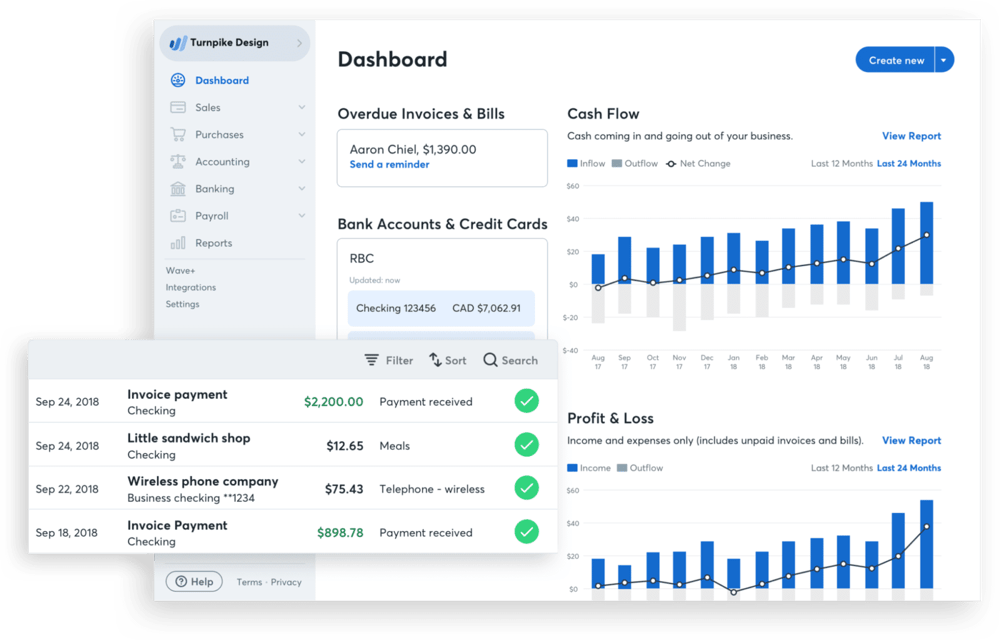

A cloud-based integrated accounting solution, Wave is designed for the needs of small businesses, freelancers and consultants. Its features include accounting, invoicing, billing, payment tracking, and payroll management.

Wave comes with a mobile receipt scanning app, which lets you review information on receipts scanned with the app prior to approval. It also syncs with your Wave account to ensure you always have an accurate overview of your business expenses.

The scanning app works even when you’re offline, and will automatically sync when you have re-established a data connection on your mobile phone.

Should you receive any receipts in your email inbox, you can even forward it to a designated email address, and it will automatically show up in your Wave account for your review.

For businesses in the manufacturing or distribution industries, inventory turnover reports are useful for keeping track of the business’s current inventory of products and inventory turnover ratio i.e., how quickly that inventory is moving through your warehouses and getting sold to consumers.

The higher your Inventory Turnover Ratio, the more likely that your business is overstocked, and the longer your cash is tied up in your inventory.

Not only would this mean that your business possesses less liquid funds to pay your employees or fulfil its payments to suppliers, lenders etc., it even risks incurring losses should demand for the inventory drop for any reason.

For example, your inventory could be obsolete by the launch of a newer version of the product. Or it could be perishable, which means it has to be sold before it reaches the end of its shelf life.

To that effect, inventory turnover reports can promptly alert you to any issues regarding the movement of your inventory, allowing you to take measures to rectify the problem in time.

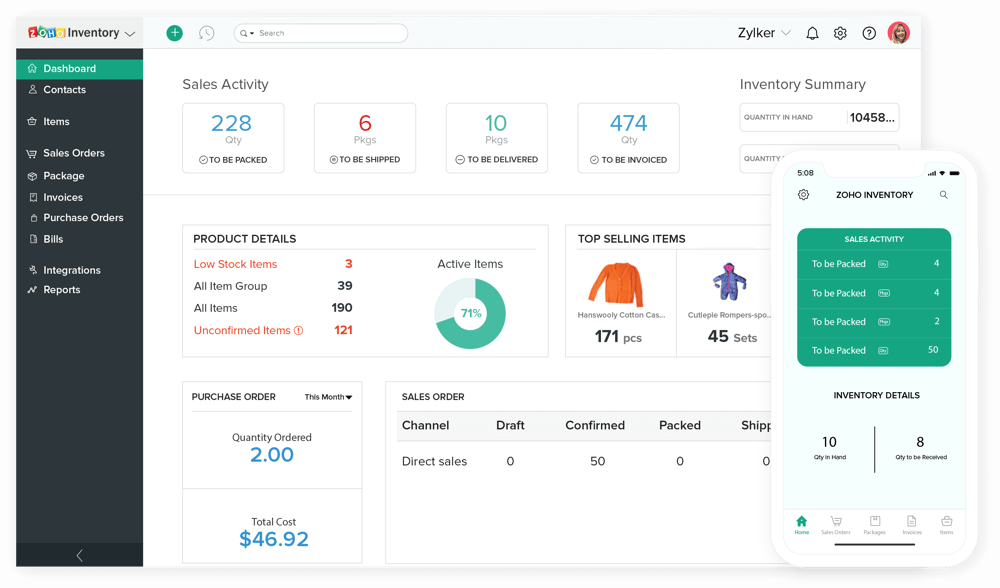

An online inventory and order management application, Zoho Inventory gives your business powerful inventory management features. This includes end-to-end tracking, mobile tracking for Android and iOS devices, and warehouse inventory management.

Zoho Inventory also includes sales and purchase order capability, which allows you to enter sales orders into the system manually or through an integrated online sales channel. This makes it suitable for retail businesses in Singapore, as product sales are tied directly to warehouse inventory.

Although it is conceived as a standalone system, you can easily integrate Zoho Inventory with other Zoho products – such as Zoho Books and Zoho CRM – for a fully integrated retail management system.

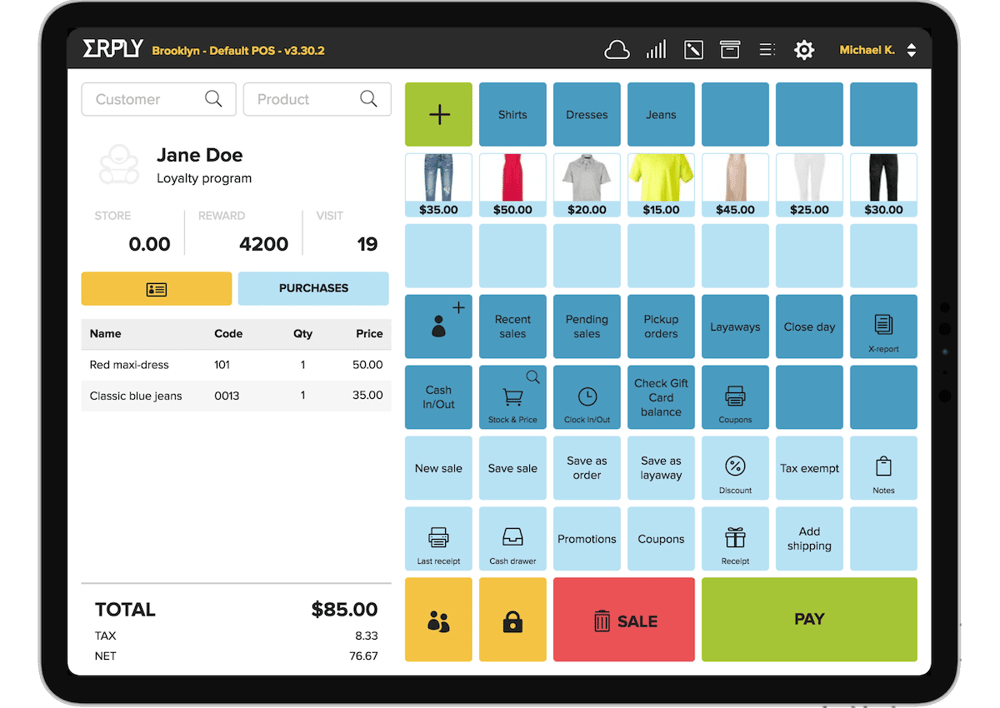

Specialised for the needs of the retail industry in Singapore, Erply is a cloud-based point-of-sale (POS) system designed to scale with a growing business. It can integrate with e-commerce platforms such as Shopify to help extend your reach to your customers.

It comes with inventory management software with reporting tools that track your sales and stock levels and keeps a history of your inventory that facilitates reconciliation of your stock accounting and write-offs.

Because it is cloud-based, Erply comes with a mobile warehouse management system (WMS) app. This means that whether you’re in your warehouse or on the shop floor, you can use the app to take stock of your inventory or initiate an existing transfer order at any time.

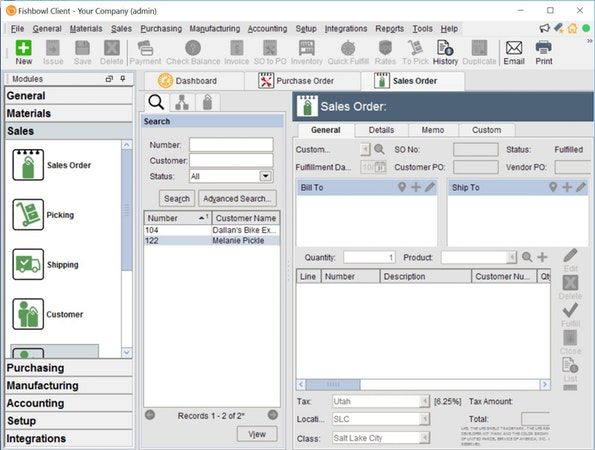

A hybrid manufacturing and warehouse management solution for SMEs in Singapore, Fishbowl Inventory offers inventory management functionality for manufacturers and distributors.

It also offers several other key features, such as job shop floor control, work order management, manufacturer orders and bill of materials. Fishbowl Inventory is capable of predicting inventory requirements based on sales trends, allowing you to transfer stocks from one warehouse to another.

Billing itself as the #1 manufacturing and inventory management software for QuickBooks, Fishbowl Inventory can also integrate with e-commerce platforms such as Shopify and Amazon.

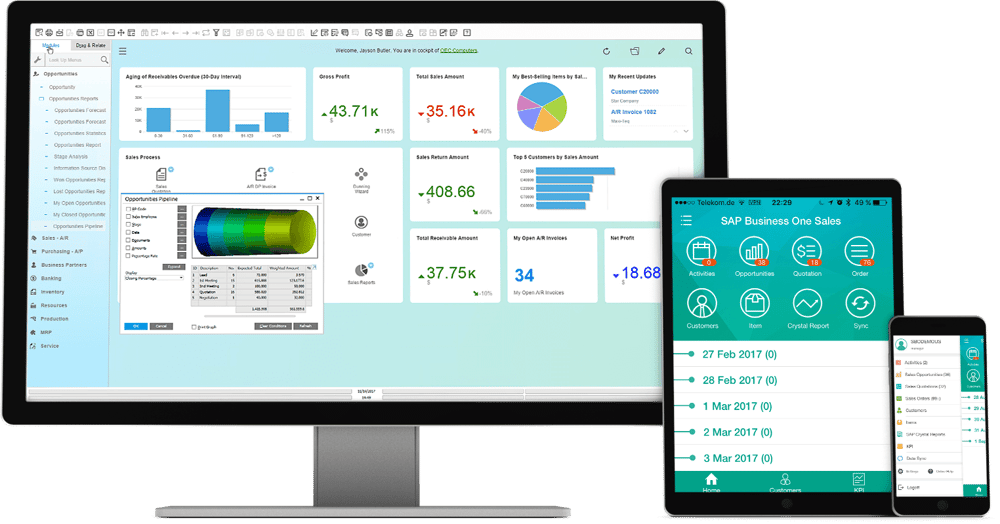

If neither standalone tools nor add-ons for accounting software are what you’re looking for, and you’re looking for an ERP system that can handle your inventory management needs instead, we recommend SAP Business one.

This is because it comes with a robust inventory management module that helps you manage your inventory in real-time, across multiple warehouses.

Purpose-built to cater to the business needs of SMEs in Singapore, Business One connects inventory with other business functions such as accounting, sales and purchasing, ensuring efficient and accurate inventory management.

It also uses real-time data to generate up-to-the-minute reports, ensuring that you always have an accurate overview of your inventory.

While SAP Business One can be hosted on the Microsoft SQL platform, you also have the option of the much more powerful SAP HANA in-house platform, amongst other benefits. Doing so gives you access to advanced inventory status check functions, cash-flow forecasts, and other features.

Lot tracking (or batch tracking) lets you trace products along your distribution chain using lot numbers. It lets you track your products from end-to-end, from raw materials to finished goods, as well as expiration dates if your products come with one.

Lot tracking offers numerous benefits to businesses, the chief of which is to facilitate product recalls. A lot tracking system gives you the detailed information you need to identify every defective product within the batch, allowing you to retrieve them much more easily.

Handling a product recall effectively also means that your business retains a high level of customer trust and preserves your good reputation in the market.

But manual batch tracking systems can take up a lot of time and are prone to errors. This is why an automatic lot tracking system can help you to generate information across an entire batch of products and put it at your fingertips for quick access.

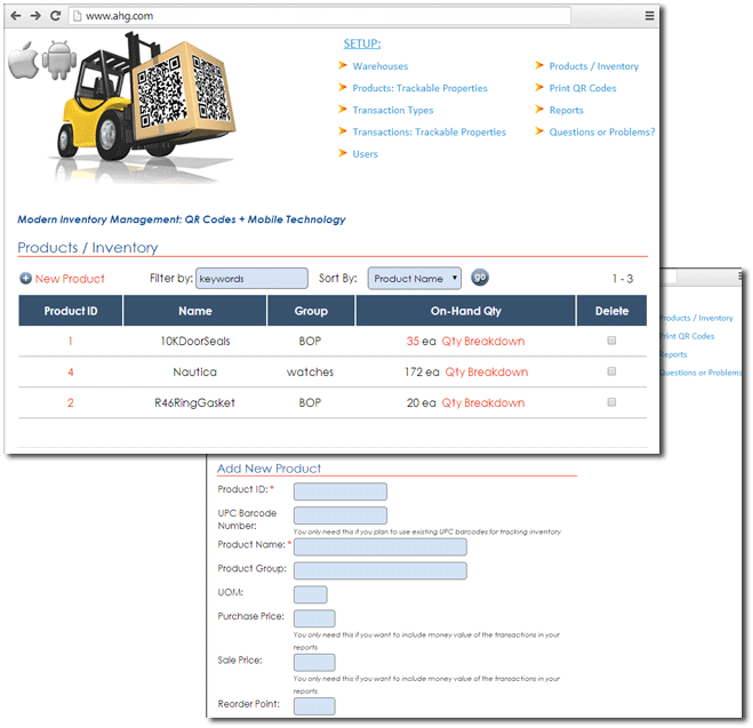

A cloud-based inventory management system designed with Singapore’s SMEs in mind, the core feature of QR Inventory revolves around letting you create eponymous QR codes for inventory tracking purposes.

This helps you do away with the need for hardware accessories such as barcode scanners, as all you need to track inventory is an Android or iOS device to scan the QR codes.

Beyond the QR label generation feature, QR Inventory features standard inventory management applications. This includes lot traceability and workflow tracking. You can also configure QR Inventory to define what data should be collected on each new inventory lot, giving you all compliance documentation at your fingertips.

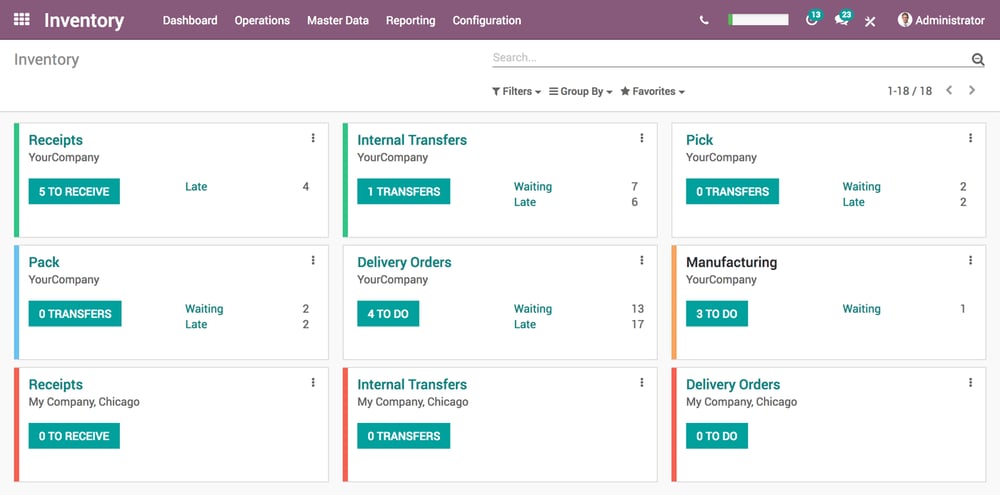

An open-source inventory management software, Odoo provides companies in Singapore with all the features of a complete ERP system. However, its inventory management module is free for an unlimited number of users as a standalone.

This module comes with robust features by itself, which includes a double-entry inventory system that lets you trace your product lots upstream or downstream from anywhere within your supply chain.

You can also add custom fields to your products and track them accordingly, such as expiration dates and different product measures.

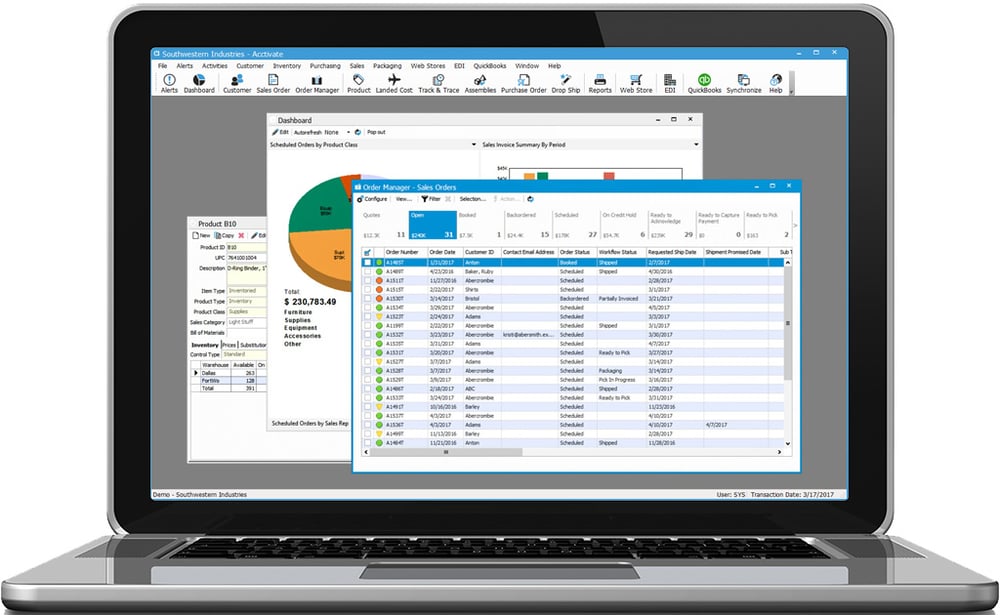

An inventory management add-on for QuickBooks, Acctivate extends the accounting software’s inventory and business management functionality for its users in Singapore. It can be helpful for manufacturing, distribution and online retail industries.

It comes with a full set of inventory management features to provide increased inventory control. This includes a lot/serial number tracking feature that allows you to trace an unlimited number of products back to their suppliers, through outsourcers or to customers.

You can consider Acctivate if you need inventory management functionalities for your growing business but would rather retain QuickBooks for your accounting needs instead of shelling out for QuickBooks Enterprise or a new ERP system.

A cloud-based app for Singapore’s manufacturers, wholesalers and distributors, Unleashed is a powerful inventory management software. It lets you manage not just inventory, but also purchasing, sales, customers and production.

Capable of integrating with Xero to lend the accounting software platform its extensive range of capabilities, batch tracking is one of Unleashed’s inventory features.

Its comprehensive batch tracking feature set allows you to trace all your products with ease, manage your raw materials effectively, and ensure your products comply with quality and safety standards.

Although business reporting tools and business intelligence (BI) tools tend to be used interchangeably, there is a large difference between them despite their outward similarities.

Research Indicates That SMEs Are More Likely To Invest In BI Tools. Click Here To Find Out Why.

Reporting tools present data about a specific area within your business using a fixed format. This makes them useful, especially for front-line and operational personnel in Singapore, who need to know specific business information to carry out their roles and nothing more.

On the other hand, BI tools offer a strategic perspective, presenting data in a way that gives management and business owners like yourself actionable insights on potential business opportunities.

Therefore, reporting and BI tools serve different purposes, despite their superficial similarities. But both tools are essential for your business to keep you and your employees up to date on the important data for your respective roles.

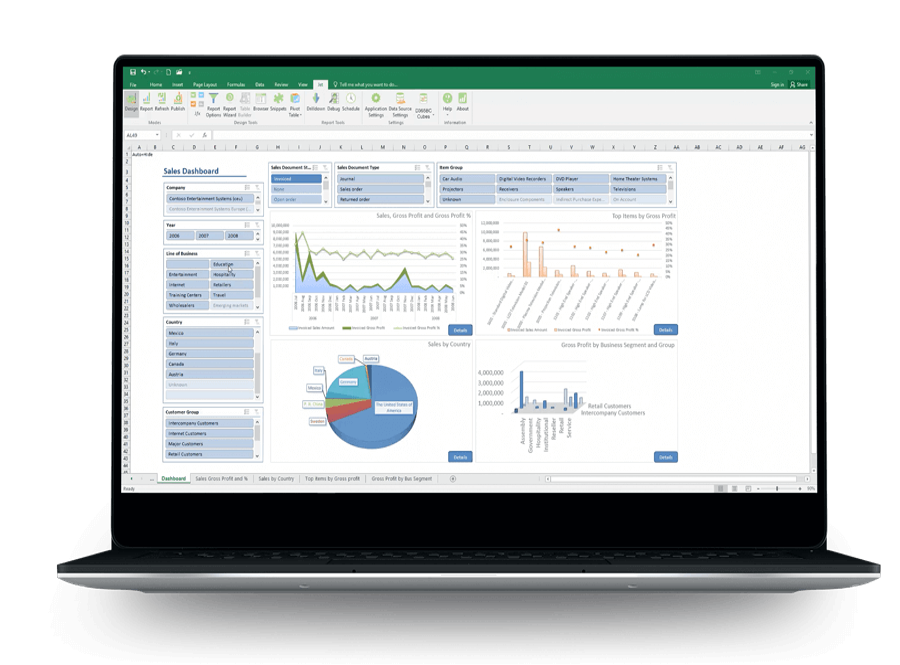

Part of the Jet Global family of financial reporting, analytics, and budgeting software solutions, Jet Reports offers rapid, flexible yet comprehensive reporting capabilities. With the help of Jet Reports, you can save time and costs on manual report generation.

Part of the Jet Global family of financial reporting, analytics, and budgeting software solutions, Jet Reports offers rapid, flexible yet comprehensive reporting capabilities. With the help of Jet Reports, you can save time and costs on manual report generation.

By The Way, Do You Know That AFON IT Has Been Named The Top Partner For Jet Global In Asia Before?

Since it works as an add-in for Microsoft Excel, Jet Reports also integrates seamlessly with Microsoft Dynamics 365 Business Central. Additionally, it can pull real-time data directly from the latter’s database to generate its reports.

insightsoftware Has Also Named AFON IT the Jet Global Asia Top Elite Partner Of The Year 2020.

This means firms in Singapore will get reports in the familiar context of Excel spreadsheets without having to be an expert in Excel functions to design reports to their preferences.

A purpose-built financial reporting solution from insightsoftware, Spreadsheet Server offers real-time finances and operational reporting. This is achieved by connecting directly to ERP software such as NetSuite and SAP Business One while presenting it in the familiar environment of Microsoft Excel.

Spreadsheet Server extends the native reporting capabilities of ERP software with purpose-built financial and operational reporting features and tools. This allows business leaders in Singapore to make important decisions with accurate data.

It also comes with its own Intellicast add-on. This allows you to publish trusted financial information from your ERP system to your intended audience in a form that non-finance users can readily understand and act upon.

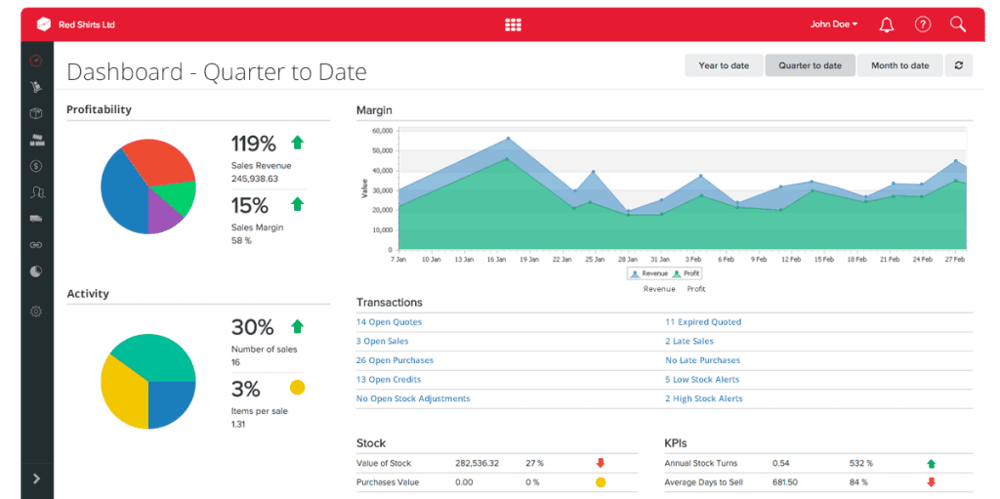

An all-in-one business intelligence (BI) software that integrates multiple data sets (such as databases, external applications, spreadsheets etc.), datapine consolidates your business’s data from various sources. It then visualises the data for you through interactive dashboards.

The BI solution is designed to make data comprehension easy for business owners, and thus its design emphasises user-friendliness. You can create a wide range of charts and tables to help yourself understand trends in your business.

datapine also makes it easy for you to share the relevant business metrics with your key personnel, with full control of access rights to ensure that each individual sees only the data they are supposed to.

You wouldn’t think something as powerful as a BI tool could be free (much less from one of the largest software vendors in the world), but that’s exactly the case with Microsoft’s Power BI.

Power BI lets you pull different data sources into a single dashboard, which presents the collated data through immersive visuals to help you acquire accurate insights into your business processes quickly.

There are two versions of Power BI. The free version gives you access to its basic features, while the paid Power BI Pro enables you to collaborate, amongst other additional features.

Financial, reporting, and inventory tools will become increasingly important to the role of finance leaders in Singapore like yourself in the coming decade.

That’s because the days of the finance department being solely responsible for regulatory compliance and corporate governance have come to an end.

On the other hand, finance will be increasingly seen by CEOs and stakeholders as an equal partner in driving business strategy.

You will be expected to provide insights to that end, based on the financial data which they will assume you can bring to the table.

And with these reporting tools, you can save time by not needing to generate reports manually and can instead focus on interpreting the data to get the insights you need.

Because of this, these tools will be invaluable in your transition to your role as an equal partner in the informing and driving of overall business strategy.

We hope you found this guide informative. If you want to know more about some of the tools and solutions that could equip you for the next decade, feel free to drop us an enquiry here, and one of our ERP consultants will get back to you shortly.

Alternatively, you can get your free copy of the white paper below to find out how you can take the data that the tools above can generate, and use it to create a value-added finance function for your business.

1 Commonwealth Lane, #07-19/21

One Commonwealth

Singapore 149544

Tel: (65) 6323 0901

Fax: (65) 6323 3177