We’re coming up onto the end of the year, and the next one is just around the corner.

If the Financial Year End (FYE) of your business is the same as the last day of the calendar year, this means that you’re probably busy planning for the financial year-end closing process of your business.

And even if your business’s FYE is set at some other date, your business will still have to file its Corporate Income Tax Return (or Form C-S/C) by December 15.

Chances are, you’re not looking forward to it.

After all, you’re already familiar with the issues you’re going to encounter in the process, such as;

- Financial data that is outdated or just inaccurate.

- Unpleasant surprises that only show up during the closing process.

- Errors which had not been found until now, even though the monthly/quarterly closing processes could have uncovered them.

- Breakdown in communication of information, especially between departments.

Nevertheless, the closing process still needs to be carried out so that your business remains in compliance with the regulatory requirements of IRAS.

Making the year-end financial closing process more efficient also comes with benefits. It allows your finance function to spend less time gathering data, and more time on data analysis.

This expedites your access to financial information, enabling you to make informed business decisions more promptly. Additionally, errors and omissions can be found and corrected more effectively, ensuring data integrity and reliability.

Publishing financial results early also boosts stakeholders' and investors' confidence in the business's strong financial systems and procedures.

Here are some tips we’d like to share that might help ease your FYE closing process, and better prepare you and your business for next year’s closing as well.

1. Set SOPs For The Financial Close Process

According to a white paper co-authored by Deloitte and SAP, many companies lack a set of standard operating procedures (SOPs) for carrying out their financial close processes.

Instead, it is all too often carried out according to institutional memory, or in other words, how it’s always been done in the company.

If this seems like the case for your business, you may have noticed how it’s hard to determine the current progress of your close process.

The tasks that need to be done to complete the close process are probably not collated in a single spreadsheet, and instead scattered across several spreadsheets possessed by various teams and departments.

This means that no clear benchmarks have been set in your close process, which in turn means that progress is not tracked by anyone in the process.

This lack of real-time insight leaves you unable to identify any bottlenecks that are obstructing the quick completion of your close process, and reliant on meetings with everyone involved to get an idea of how things are going.

Even an attempt to automate your close process is not going to help, if you don’t have a clear understanding of how long each task takes to complete, and the dependencies involved between the various tasks.

Therefore, you have to start by implementing a set of SOPs for your close process, and ensuring that all involved in it are committed to following them.

2. Break Down Silos to Facilitate Collaboration

If your business is used to carrying out the close process through institutional memory, it probably means your teams and departments have formed data silos, and not sharing relevant data with each other.

For example, if your business is set up so that a separate team in your finance department handles the close process, they probably have little interaction with the rest of the department handling the day-to-day numbers.

This lack of data sharing means no one is responsible for cross-checking the data in the process for any errors or oversights, and thus you cannot trust that the data you’re receiving is accurate.

To break such silos down, you should implement an integrated business planning (IBP) approach – aligning strategy, operations and finance by connecting the planning functions of every department with each other.

While such an approach was not feasible in the past due to the massive amount of data that needed to be shared across departments, it is now very much possible with today’s advances in technology.

However, you must make sure that you get commitment and buy-in from everyone involved in the close process to collaborate with one another, and to lay down the SOPs for doing so.

Achieving this level of collaboration will be a complex undertaking, but it can be made easier with the right sort of underlying technology to lay the foundations of the collaborative process.

3. Implement Real-time Data Reporting Tools

You may have noticed throughout the year, that unpleasant surprises tend to show up in the financial data most often at the end of each month.

You may have noticed throughout the year, that unpleasant surprises tend to show up in the financial data most often at the end of each month.

This is linked to your month-end financial closing periods at your business, when everyone is uploading the most up-to-date data into the monthly closing process.

Because of this, you’ll get access to the most accurate financial data only at the end of the month.

Yet business decisions cannot wait for the data to arrive at your desk, and you’ve probably experienced occasions where you had to make decisions without the data to inform your choices.

That’s not great, but what’s worse are the unpleasant surprises that could have shown up during one of your month-end closings, but did not become apparent until your year-end closing.

Such oversights might have been caught earlier if only you had access to accurate, real-time financial data; but this was not viable in the past.

Thankfully, advances in technology have made it possible for you to gain access to real-time data about your business’s financials where it was not possible before.

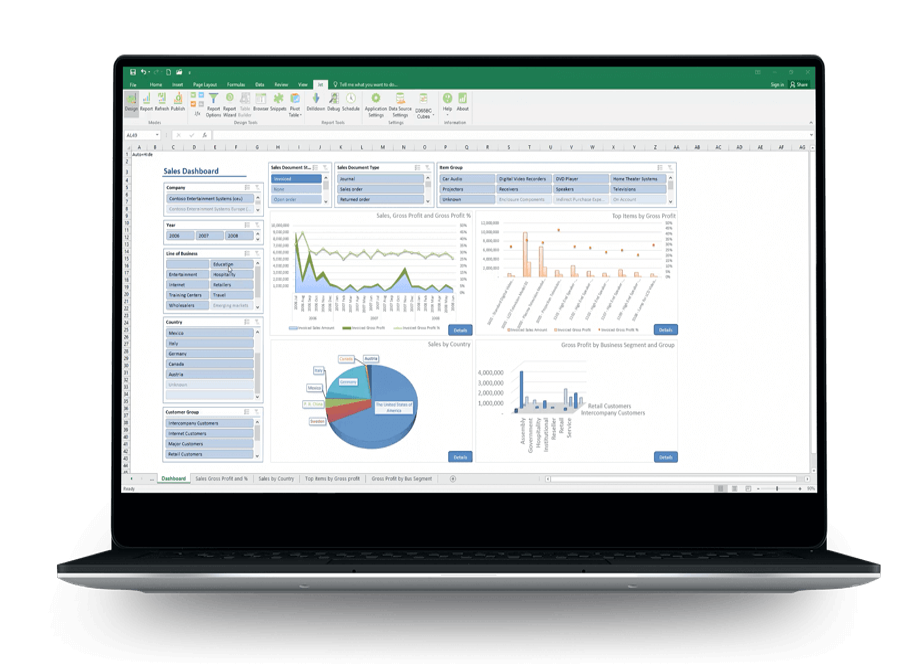

Business intelligence (BI) and reporting tools can now put all of the real-time financial data at your fingertips, and bring your business closer to the ideal of the continuous close.

Once you’ve put these tools in place within your business, it will help your business become much more efficient at conducting its monthly close processes.

This in turn will go a long way towards improving the efficiency and quality of your year-end close.

4. Implement Automation In Your Close Process

Now that you’ve established a set of SOPs and facilitated collaborative efforts from all personnel involved in the close process, you can start optimising the close process itself.

The most likely reason for your close process being inefficient and error-prone is because it’s being carried out manually in many organisations.

It takes a lot of manual effort to assess, reconcile and verify the data generated by a business, and this problem only gets worse with multinational companies (MNCs), which need to juggle country-specific information and processes on top of that.

And this is almost certainly because your legacy IT systems are not integrated and thus unable to share data, necessitating tedious and mistake-prone manual work to transfer data from one disparate system to another.

This means that integrating your IT systems is a prerequisite for automating your close process, which is best done by implementing an ERP software in your business.

An ERP system can integrate your existing IT systems and draw the relevant financial data from them, which is then collated into a central database.

This gives you accurate, real-time information on your business’s finances, without the possibility of human errors caused by oversights in the manual verification and reconciliation process.

ERP systems can also automatically handle mundane, repetitive tasks such as posting of G/L journal entries and generating financial statements, saving your people the need to carry them out manually.

With an ERP system, your close processes are less likely to be delayed by key personnel being unavailable, or sidetracked by competing priorities on your people’s to-do lists.

The FYE Close Process Doesn’t Have To Be So Hard

Technological advances presents many opportunities to greatly ease the financial year-end closing process, but you have to lay the foundations to ensure that implementation of new technologies will be successful.

Without an established set of SOPs in place, automation will not be able to resolve your difficulties with the close process; therefore, it must be handled before anything else.

You’ll also need to get buy-in from the people involved in carrying out the close process, and get them involved in collaborating and sharing relevant data in the course of the close process.

To track the progress of the close process, you’ll want to deploy BI and reporting tools to get access to real-time financial data.

And last but not least, you may want to consider implementing solutions to automate both the close process and the Last Mile afterwards, such as integrating your legacy IT systems with an ERP software solution.

With all these steps in place, you can look forward to a much easier and less tedious financial year-end close process for this year, and be ready to start the next off on the right foot.