ERP software, especially cloud-based ones, are an ideal business management solution for FinTech firms like yours for many reasons.

And when it comes to cloud ERP software, Oracle NetSuite and Sage Intacct are the most often cited solutions best suited for FinTech firms like yours.

It’s easy to see why. Both NetSuite and Intacct are cloud-based, multi-tenant software-as-a-service (SaaS) solutions that are designed for the needs of the financial services industry.

But the similarities end there. The question is, which of the two cloud ERP software is the better choice for a FinTech firm like your business?

Let’s take a look at several features that are critical to the success of FinTech firms like yours, and find out how well NetSuite and Intacct fulfills your business needs respectively.

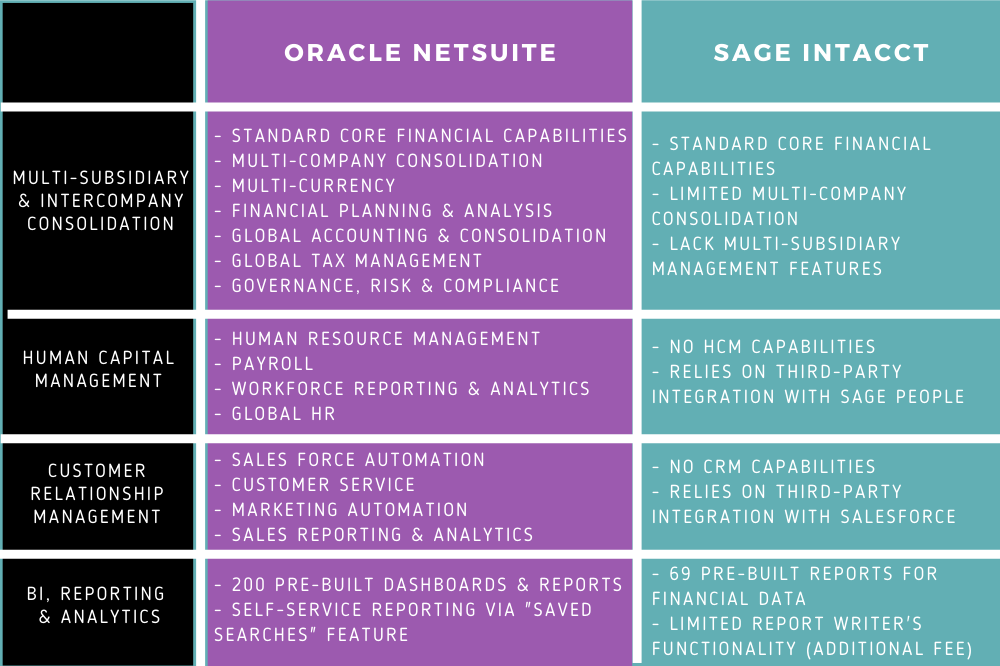

Feature Comparison: NetSuite vs. Intacct

Feature Comparison Table Between Oracle NetSuite and Sage Intacct

Feature Comparison Table Between Oracle NetSuite and Sage Intacct

Multi-subsidiary And Intercompany Consolidation

%20(1).jpg?width=1000&name=scott-graham-5fNmWej4tAA-unsplash%20(1)%20(1).jpg)

To facilitate the rapid growth and expansion into new markets that FinTech firms are known for, it’s especially important that your cloud ERP software has the functionality to facilitate multi-national operations.

With the OneWorld module, NetSuite can provide your FinTech firm with the necessary features.

NetSuite OneWorld enables multi-subsidiary and intercompany consolidation. This means your FinTech firm is able to unify financial data from all of your subsidiary entities located in various countries, and establish consistent business processes between them.

Additionally, NetSuite OneWorld supports 27 languages, more than 190 currencies, transactions in more than 90 bank formats, and tax and reporting standards for more than 100 countries, allowing your FinTech firm to conduct business in almost any corner of the world.

On the other hand, Intacct does not have native support for multi-subsidiary operations and intercompany consolidation. This means that each of your subsidiaries requires its own Intacct license.

Moreover, Intacct’s batch-based subledger architecture makes multi-subsidiary consolidation difficult for your FinTech firm, as you wouldn’t be able to get real-time data from your subsidiaries.

It also doesn’t provide intercompany reports out of the box, and you’ll have to subscribe to its Customisation Services or Platform services in order to generate custom reports for your subsidiaries.

Intacct also doesn’t support multi-currency transactions, nor for languages other than English, making it difficult to use in non-English-speaking locales.

Thus, Intacct would not be an ideal choice if you’re planning to pursue business expansion overseas for your FinTech firm.

Human Capital Management

%20(1).jpg?width=1000&name=austin-distel-wawEfYdpkag-unsplash%20(1)%20(1).jpg)

As a FinTech firm, your employees are key to the success of your business. Because of that, you probably want solutions that provide human capital management (HCM) functionalities to optimise your hiring, onboarding and payroll etc. processes.

NetSuite offers a comprehensive HCM suite built into the ERP software, and includes key features such as employee recognition and compensation, performance, attendance, and leave management.

The cloud ERP software also has a comprehensive payroll functionality, which will help ensure that your employees are fully compensated in a timely manner.

On the other hand, Intacct can provide some of the core HCM functionalities you need with Sage People. However, the latter is a separate 3rd-party software, which requires a complex and expensive integration to make it work with Intacct.

Customer Relationship Management

.jpg?width=1000&name=pexels-fauxels-3184639%20(1).jpg)

Your FinTech firm may have a product or service to sell, but how do you know your target customer base will buy what you have to offer?

With a solution that provides customer relationship management (CRM) functionalities, you’ll be able to gather crucial data from your customer-facing processes, and gain important insights which you can leverage to develop offerings better suited to answering your potential customers’ needs.

When considering a cloud ERP software for your FinTech firm, you should know that NetSuite also offers a full CRM suite with key features such as sales force automation, customer service management and marketing automation, should you want it.

And because it comes built-in on the NetSuite platform, its CRM functionalities can access important customer information such as billing and inventory in real-time, too.

This means your sales, customer service, and marketing teams will have the customer data they need whenever they need it, enabling them to react in real-time and be more effective in helping your FinTech firm convert and retain more customers.

On the other hand, Intacct does not come with built-in CRM features. The Sage cloud ERP software relies on an integration with the SalesForce.com CRM platform to provide those.

Business Intelligence, Reporting And Analytics

%20(1)%20(1).jpg?width=1000&name=campaign-creators-pypeCEaJeZY-unsplash%20(4)%20(1)%20(1).jpg)

To stay ahead in an increasingly competitive industry, your FinTech firm must strive to better understand your customers’ needs, identify market trends, pinpoint cybersecurity issues to be resolved, and provide a great user experience.

And this is what makes business intelligence (BI) and data analytics tools indispensable to FinTech firms like yours.

Therefore, you’d want a solution with robust BI and reporting capabilities. You’ll get that with NetSuite, as the cloud ERP software provides self-service reporting through the “Saved Searches” feature, eliminating the need for coding at the user level.

It also offers 200 pre-built dashboards and reports that are sorted by role and industry, including those designed for FinTech firms like yours. And these reports are populated with data from your business in real-time, giving you full visibility into your FinTech firm.

On the other hand, Intacct offers only 69 pre-built reports for core financial data out-of-the-box.

You could create your own reports in Intacct using a report writer that lets you combine operational and financial data. However, you need to pay an additional charge to use it, and it’s limited in its configurability and the data elements that you can include in your customised reports.

To acquire more reporting functionality within Intacct, you’ll have to resort to third-party add-ons, which leads to increases in costs and complexity.

FinTech Firms Are Better Served Choosing NetSuite Over Intacct

.jpg?width=1000&name=pexels-andrea-piacquadio-926390%20(1).jpg)

After the comparison of key features and functionalities, we can see that your FinTech firm would be better served opting to implement Oracle NetSuite over Sage Intacct.

That’s because NetSuite has several built-in features that contribute heavily to the future success of your FinTech firm – multi-subsidiary and intercompany consolidation, HCM, and CRM – that Intacct doesn’t have built into its own platform.

Additionally, NetSuite offers a more robust BI and data analytics feature set than Intacct, which is also key to providing full, real-time visibility into the health of your FinTech firm.

Thus, it’s clear that NetSuite is the superior choice of cloud ERP software for supporting your FinTech firm’s operations and future expansions over Intacct.

To see more reasons why fast-growing businesses like your FinTech firm are choosing Oracle NetSuite over Sage Intacct, click on the image below to learn more.