Are you tired of spending days every month preparing and producing the same-old financial reports? Frustrated, because you feel your current role is not fulfilling your full potential as a finance manager?

Instead of contributing actively to strategic data-driven discussions with your Chief Financial Officer or Financial Controller, you spend most of your time correcting errors in financial reports or fighting to improve internal controls.

If that’s you, you’re not alone. A report by The Data Warehousing Institute notes that most finance managers attempt to get insights by pulling data directly from one or more systems, and then manually connecting the data in spreadsheets.

This tedious approach creates analytical silos that result in inconsistent data, which in turn undermines a business’s ability to derive accurate, deeper insights.

LEARN ABOUT THE TEN BEST PRACTICES FOR CREATING REPORTS. CLICK HERE TO DOWNLOAD YOUR FREE GUIDE NOW.

What is Business Intelligence (BI)?

In a sense, business intelligence tools are like crystal balls into the performance of your business.

The point of Business Intelligence applications is to help you and your bosses make better and faster decisions. It does so with a myriad of tools and functions to help you with decision-making.

At its core, BI tools collect relevant data and presents them through data visualisation — making data meaningful and actionable for you.

Combined with data from a good enterprise resource planning (ERP) system like SAP Business One or Oracle-NetSuite, you could uncover answers you never thought possible from across the organisation.

Think human resources, financial materials, other company assets and more. Picture being able to unearth and discover hidden patterns and trends that could affect your organisation’s performance.

With these insights, you could help your finance leaders in making key business decisions and respond quickly to what the data is saying. In turn, the answers uncovered will help your finance team play a more proactive role in driving critical value for the business.

More advanced BI solutions come with predictive modelling, data & text mining, analytics, and more.

Power BI is a business intelligence tool developed by Microsoft.

Here Are Three Ways Business Intelligence Can Change the Game for Your Finance Team

1. Gives everyone rapid updates and data visualisations, helping you save time and resources

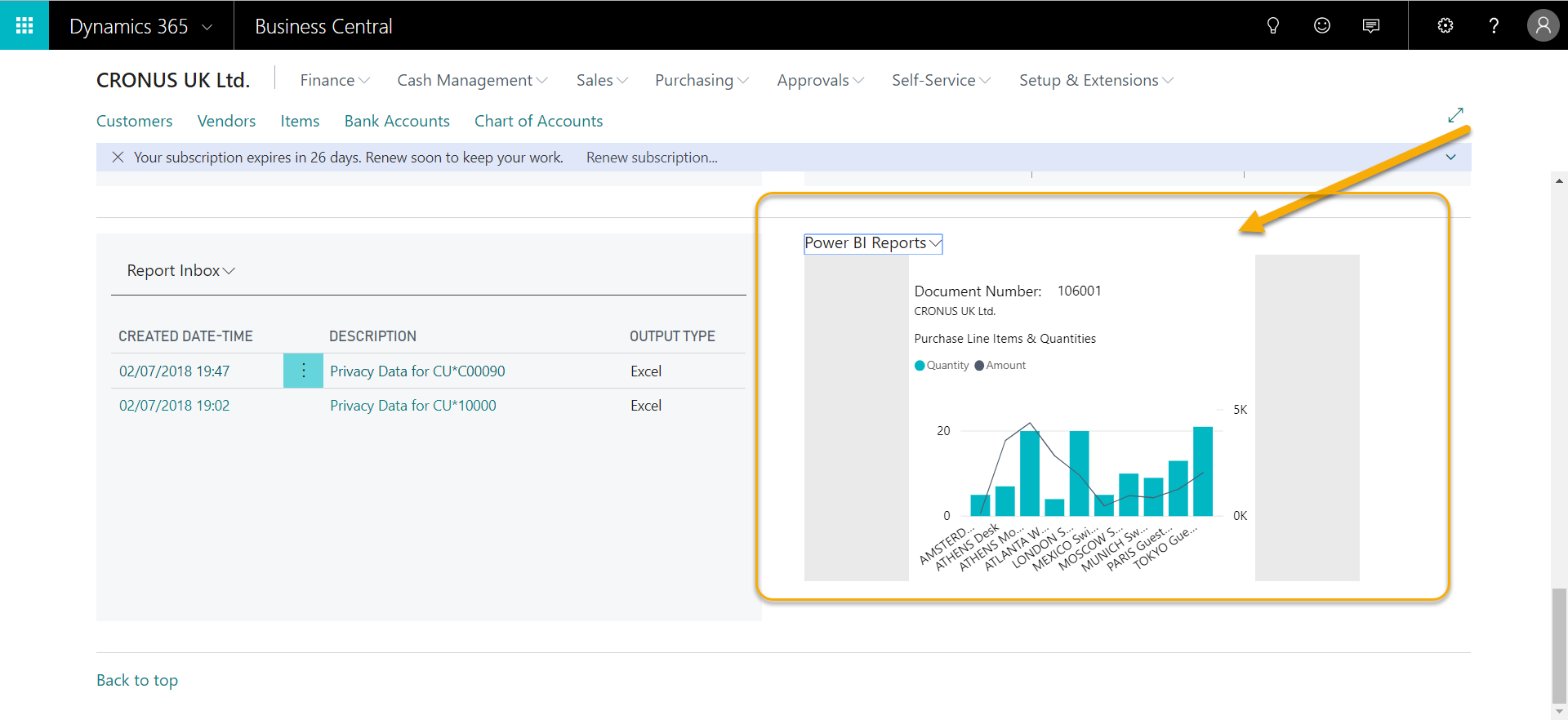

Not only can you connect Power BI to multiple sources, Power BI can also be embedded in some sources like Microsoft Dynamics 365 Business Central, so you can visualise your data within your ERP system. Source: Microsoft Dynamics Community

The finance department manages money and how it flows around the company. It acts as an internal control for how resources flow within the organisation.

Traditionally, this leads to two scenarios.

One, there’s an unspoken expectation that the finance team is responsible for providing the rest of the organisation with information whenever they need it.

Two, your team spends a lot of time waiting on the IT department and other departments (and vice versa) to process information and report requests.

Now imagine if all the key people across your organisation has access – to some extent – to the same information. They could quickly view snapshots of relevant financial and performance information on their own personalised dashboard, without sending repeated requests to finance to churn out reports for them.

Essentially, your team no longer has to take sole responsibility to provide the rest of the company with information they could discover on their own.

This frees you up to focus on the next point:

2. Turns your finance expertise into a cornerstone for business strategy

For decades the finance department has been viewed primarily as a back-office role, with little part to play in the strategic process.

Most of their day-to-day resources were spent on preparing internal and external financial reports. Data entry and consolidation alone would consume a large portion of their time.

In fact, one of the growing challenges modern finance teams face is not the lack thereof of information, but managing the sheer overwhelming amounts of data that lack clarity, accuracy, and relevance.

In one Accenture survey, 54% of senior finance executives said they only had only half the information needed to provide visibility into performance. Another report describes how many businesses are “still struggling to make progress with… analytics.”

BI solutions can be fully integrated throughout your business information systems. It will boost your system capabilities to capture and organise data - making information more readily available for you when you need it.

And because BI tools are designed to extract actionable insights from the data, it enables your team to act less like bookkeepers and more like strategic advisers.

For example, you and your senior management can easily review your organisation's cash flow, liquidity, return, equity capital and more at any time across all business units. Your discussions can then be substantiated with the latest figures, with the option to drill-down to the transaction levels for specific causes, for more meaningful exchanges.

Donny Shimamoto, CPA/CITP, and founder of Intraprise TechKnowlogies, explains this well.

At the AICPA Financial Planning & Analysis Conference held a few years back, Shimamoto spoke about the role of accountants / finance professionals today, and why he believes finance should take ownership of the BI role – both for the sake of the organisation and finance professionals everywhere.

Donny Shimamoto, CPA and business productivity expert. Source: GoingConcern

In the most conservative quadrant lies the steward role, whereby the person is mostly responsible for reporting and transaction processing.

The next quadrant lies the trusted reporter (or ”watchdog”). Here the person carries out duties that include compliance to GAAP, IFRS, the Sarbanes-Oxley Act etc.

In the third quadrant, the finance professional’s role encompasses greater specialised technical expertise.

“These are people that are really strong in supporting specific functions,” says Shimamoto. “They might have industry expertise or experience in activity-based costing or treasury management.”

It’s the fourth quadrant where Shimamoto hopes more finance professionals can aspire towards. By choosing to move beyond their comfort zone, they can move out of the first two quadrants and land a more visible and strategic role in their organisation.

3. Has a relatively low acquisition cost and learning curve

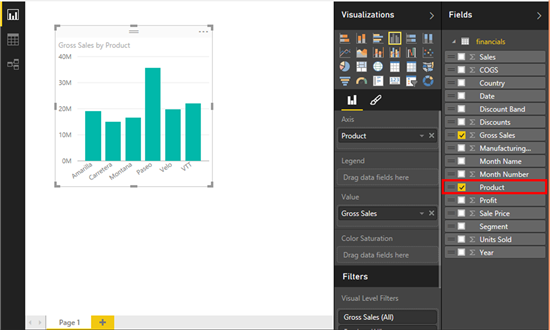

You can create an immersive, visual report through a simple drag-and-drop interface. Source: Microsoft Power BI Blog

In the past, it used to take skilled individuals to know what to do with the data and how to present information in a way that would uncover key insights.

For finance teams, this meant relying heavily on the capabilities of the IT team to get the information they needed. Many small and medium-sized enterprises (SMEs) who lacked the budget and IT expertise to do so were left out.

Instead, large multinational corporations with the technical resources to do so benefited greatly from BI capabilities. These global giants had their own data warehouses, IT teams, and data analysts to plough through massive amounts of data to make useful interpretations.

But things have changed. According to Shimamoto, finance teams today don’t need to fret about learning data or IT skills, thanks to the rapid improvement and affordability of BI tools.

“The tools have evolved to become so user-friendly that you don’t need IT to help get the information,” explains Shimamoto. “It’s evolved now so finance can do it all on [its] own. That’s a huge change within the last decade.”

Now modern BI solutions like Power BI can convert data into visualised reports using dashboards and graphs very quickly. You can harness on this capability to paint a cohesive picture throughout the firm, and you can even start on this for free.

BI Tools: The Essential Advantage for Finance Managers

Faster insights. Accurate decisions. Strategic contributions. These are some of the potential advantages finance managers can help contribute to their leaders, with the right BI tool.

By moving beyond just keeping numbers and figures organised and manageable, finance managers can take a more proactive, intelligent approach in building up their organisation’s capabilities.

In turn, it can help transform the finance department from a supporting role to one which can provide critical insights and contribute actively to the strategic process.