These days, political shocks have become a regular occurrence.

A leader of the free world tweets a thought in the moment; the next instance the markets react like a cat on scalding bricks.

Technology has also disrupted the dominance of established professional service firms. New tech-savvy rivals, and the rise of intelligent Cloud self-service software for accounting and financials, have changed the finance leader role in unexpected ways.

Put together, and you've a recipe for a potential leadership crisis looming in the not-too-distant future.

“As (finance leaders) move up through their firm, they realise that being a good accountant is actually no more than a prerequisite to get onto the leadership starting block,” quips one senior tax partner drily.

Alastair Beddow, in his book Professional Services Leadership Handbook: How to Lead a Professional Services Firm in a New Age of Competitive Disruption, believes professional service companies need leaders capable of giving good answers to strategic questions such as:

“Which clients offer the strongest opportunities for growth?”

“What’s the right response to the threat of technology cannibalising existing revenue streams?”

It’s the only way, he claims, to build strong, visionary leadership in a disruptive and competitive environment.

If you're in a small and midsized enterprise (SME), you might be thinking this is more of a large service organisation problem.

There are however, opportunities present for SMEs to seize in the midst of this changing environment, which we'll cover later in this article.

First, let's take a look at two key driving forces that are changing the way finance leaders work in the professional services industry:

1. A Shift Towards Customer-Centricity – Even Within Finance

Professional service businesses face unique customer challenges. Unlike manufacturers whose goods’ defects can be quickly identified, true service quality is only proven much later in the customer cycle.

A service vendor's quality is therefore imputed by the customer based on intangibles like reputation or trustworthiness, until proven otherwise.

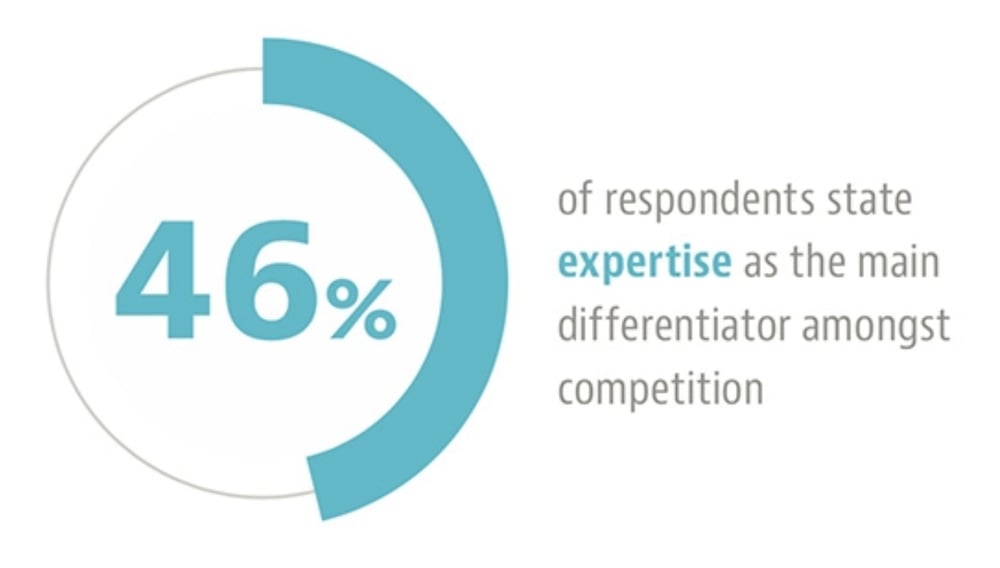

To win this trust and reputation, professional service firms have historically focused on promoting ‘expertise’.

This approach is so common it was cited as the top differentiation strategy in a study on service companies across North America, Europe, and Asia-Pacific.

Data from ResearchNow and Mavenlink. Image source: Consultancy UK

But as more tech-savvy competitors adopt agile, customer-centric strategies to challenge established businesses, expertise alone isn’t enough.

The same study saw leaders of these companies describing great anxiety over newfound customer expectations.

Customers, they say, now demand more value, higher quality of work, and a faster delivery of solutions and services, thanks to technological improvements.

They also expect more transparency and accountability in work delivered.

“We believe that customer loyalty and advocacy will increasingly become the one true way to stand out from the competition. The research clearly finds that a new basis of competition is arising. Incumbents must evolve, or risk losing business to more nimble firms with innovative business models,” conclude the study’s researchers.

In other words, the fight for customers has changed. Delighting customers, not expertise, is the new battleground for professional service firms.

And this battle has transformed expectations of finance leaders and the finance function.

A study done by FinancialForce showed nearly two-thirds of CFOs agree they felt substantial pressure to change their finance team’s mindset to be more customer-centric.

These CFOs are more likely to be involved in the product and service pricing decisions – a move some say acknowledges the customer’s new central role in the industry.

The traditional professional service model of billing on time and materials basis is also challenged by the rise of the ‘connected customer’.

These customers are tech-savvy, well-informed, and demand engagements to be tied to specific outcomes. It’s even estimated 64% of them expect companies to respond and interact with them in real-time.

“Cloud computing and the prevalence of mobile and connected devices… is changing the underlying architecture of business, as well as changing the role of the CFO, bringing the office of finance into conversations on customer experience and satisfaction,” says John Bonney, CFO of FinancialForce, in an interview with CPA Practice Advisor.

2. Impact of Cloud Technology and Automation on the Finance Function

Newfound customer expectations aside, modern cloud and mobile technologies have directly impacted the finance function in the day-to-day operations.

Thanks to cheaper and more secure Cloud-related offerings such as Microsoft Azure, more companies seeing a steady uptick in demand for subscription-based service models.

Finance leaders are thus expected to reach beyond their core capabilities to support the changing business model.

This ranges from finding new ways to support renewal revenue streams, to adopting new metrics to measure business success.

Over a third of CFOs said their top pain points in this new business model shift include billing, invoicing, and accounts receivables, as well as planning, budgeting, and forecasting challenges.

Other areas of concern include:

- Increased complexities in billing terms and schedules

With more stakeholders and revenue streams involved, finance leaders need more visibility over complexities such as performance-based schedules, project milestones etc., as well as the project’s terms of engagement and scope. - Cash flow management, especially with deferred project-based revenue

With greater customer expectations comes increased project changes, especially if the front-end systems are Cloud and mobile technology-enabled. If the finance function remains clueless about changing project milestones, it makes it very difficult to manage cash flow or plan for receivables. In turn, this has a spill over effect on forecasting, budgeting etc. - Capturing non-billable and billable time and expenses

Unplanned time and expense spent has always been a pain point for professional services companies. Along with increased expectations to provide fast, accurate insights in business productivity across the organisation, finance leaders may find themselves overwhelmed by project over-runs and non-recoverable costs that hadn't been captured in a timely manner

On top of this increasing workload, finance leaders also contend with the age-old problem of talent acquisition and management.

According to Robert Half’s Salary Guide 2019, over eight in 10 (83%) of Singapore’s CFOs said they found it highly challenging sourcing for qualified finance professionals.

With increased automation and AI-empowered Cloud technology, finance professionals are now expected to possess skills for data-driven roles, rather than task-based ones.

“Demand is increasing in 2019 for commercially-savvy finance talent with strong data analytics experience,” highlighted the report’s authors.

“These individuals can take advantage of tools such as Microsoft platforms, Data Query, Power BI and ERP systems to analyse key trends from big data and give businesses their competitive edge.”

Accounting firms are especially vulnerable to these new digital developments.

For example, intelligent financial systems with machine learning algorithms can now automate basic accounting processes. This enables their customers to bypass some of the firm’s services by managing basic activities on their own, such as filing taxes.

In short, finance executives in professional services companies face multiple ongoing challenges in a changing business environment. These range from the intangible like talent management, to more tangible concerns, such as profit margins and visibility into complex projects and utilisation rates.

So How Can Finance Leaders in Professional Services Succeed?

The most effective leaders in professional service companies are those capable of combining strategic vision capabilities, and change management skills.

That's to say, they're able to quickly anticipate and respond to trends impacting them, and at the same time directly tackle difficult issues.

Unfortunately, not all finance leaders are willing or able to do so. Common reasons for holding back include:

- A professional adversity to risks

Finance leaders are often great risk management champions. But when faced with growing uncertainties, coupled by legacy infrastructure and processes, this can lead to a myopic focus on problems instead of broader, long-term possibilities - Undervalued and/or lack of strategic leadership skills

Professional service companies traditionally promote people based on non-strategic leadership qualities i.e. who gave the longest service, billed the longest hours etc. These qualities don’t always translate to effective leadership in challenging times - Lack of resources and/or energy to manage new demands on time

Finance leaders already spend a significant proportion of their time overseeing the implementation of organisation-wide projects and managing expectations of leaders from other functions. This leaves them short of resources and energy to handle additional demands on their time

But if you're one of those finance leaders prepared to take the plunge in a changing industry, here are two ways to get started:

1. Embrace and Incorporate Digital Transformation in Your Strategy

Being a finance leader is no longer just about managing financials and challenging decisions for the sake of keeping to budget.

A better way to see this new role is that of a business enabler — a leader who enables other business functions' successes while still optimising resource usage.

And one of the best ways to start is to adopt digital transformation in your strategy to keep you leaner and more agile than the competition.

Areas to focus on include:

- Using modern, intelligent real-time technology to build closer, better customer relationships. In turn, this helps to inform product and service development

- Empowering employees by encouraging safe spaces across the organisation for experimentation and creative thinking. This helps talent-scarce SMEs develop the full potential of talented individuals

- Taking more actions directly connected to the customer, like listening to different departments and coalescing that insight with customer feedback, needs and pain points. The role of a modern finance leader is thus akin to an intersection on an information highway that cuts across the organisation — not the roadblock at the end

For SMEs, this particularly presents an advantage over larger, established firms. The Rethinking Professional Services in an Age of Disruption study ran by the Economic Intelligence Unit showed nearly three-quarters of multinational leaders surveyed believe SME providers will play an important role in their business within the next five years.

Their biggest dissatisfaction with incumbent firms lie in the low service quality and relevance, despite the high costs.

Instead, there's a trend towards a “disaggregation of services”, where multinationals break down processes into discrete steps to boost efficiency.

This leads them to seek out SMEs specialising in the relevant niches for affordable, targeted services.

2. Invest in the Right Tools to Build a Digital Core (Like a Cloud-based ERP System)

In this emerging business model, customer influence and renewals have an increasing influence on long-term growth, retention, and profitability.

Investing in the right tools to access and aggregate data is thus key to success, say researchers behind the FinancialForce study.

Just 17.4% of their respondents said they “strongly agree” their company has the operational and technological infrastructure to seamlessly handle changes in service-related revenues.

This suggests finance leaders need to consider directing more investment towards revamping their technology platform, along with deeper data analytics integration.

Unfortunately, most billing and enterprise resource planning (ERP) systems in professional service companies fail to support these emerging models and customer expectations.

These legacy systems either operate separately from customer relationship management and other front-end systems, rely heavily on third-party integrations to fill the void, or both.

What finance leaders need is to rethink how they view processes and the underlying technology supporting them. They need to be able to control multiple revenue streams while managing them in a closed-looped billing process that offers a single source of truth.

This holistic approach of managing sales, support, services etc. can only be accomplished with a unified Cloud platform strategy.

If done properly, it can consolidate billing sources across multiple contract types, build real-time revenue or customer analytic reports, support tier- and volume-based pricing, and more.

At the heart of this unified Cloud strategy is having a digital core.

Intelligent Cloud ERP software like Oracle-NetSuite are a good starting point for simplifying processes. It can streamline your accounts payable, invoice management, cash and liquidity management, and financial planning and analysis — all in a real-time Cloud platform.

And because it's a true Cloud system, it instantly connects people, devices, and business networks. This supports driving new revenues and the reinvention of business models.

Confused By the Differences Between True Cloud and Hosted Cloud Systems? Read Our Free Primer Here.

Moving From Accounting to Accountability

From newfound customer demands to the impact of Cloud technologies on finance and resource management, finance leaders in professional services companies need to recognise their role is changing to that of a business enabler.

This requires new leadership skills and fast, rapid access to cross-functional information that supports accurate decision making in an ever-changing business model.

Most of all, the most effective leaders have great resilience amidst uncertainty. They're capable of balancing confidence with just the right levels of emotional intelligence to get buy-in and change done through people.

As one former managing partner cited in Beddow's handbook warns:

"Don't expect to be the most popular person in the office – you certainly won’t be!"